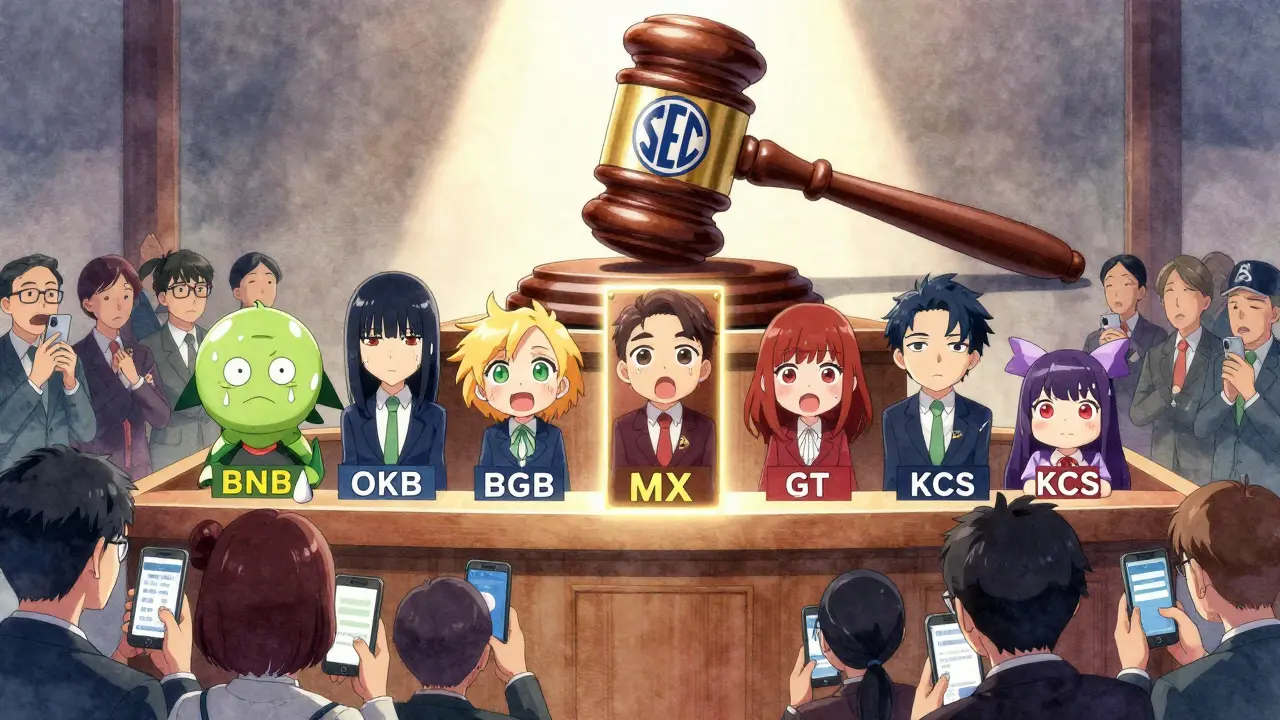

Comparing Major Exchange Tokens: BNB, OKB, BGB, MX, GT, and KCS in 2025

Dec, 19 2025

Dec, 19 2025

Exchange tokens aren’t just another crypto asset-they’re the engine behind some of the biggest platforms in crypto. If you trade on Binance, OKX, or MEXC, you’ve probably seen these tokens pop up as a way to cut fees or earn rewards. But not all exchange tokens are created equal. In 2025, six dominate the space: BNB, OKB, BGB, MX, GT, and KCS. Each has a different design, different benefits, and different risks. Knowing the difference can save you money, boost your returns, and help you avoid regulatory surprises.

What Exactly Is an Exchange Token?

An exchange token is a cryptocurrency issued by a centralized crypto exchange. It’s not just a marketing gimmick-it’s built into the platform’s core economics. You use it to pay for trading fees, earn staking rewards, vote on platform decisions, or access exclusive features like token launches or NFT drops. The first one, BNB, launched in 2017. Today, these tokens are worth over $120 billion combined, making up nearly 9% of the entire crypto market.

Most of them work the same way: the exchange takes a portion of its profits and uses it to buy back and burn its own token. Less supply over time means higher scarcity. Some also give you discounts on trading fees-sometimes up to 50%. But beyond that, their real power comes from how deeply they’re tied to the exchange’s ecosystem.

BNB: The Undisputed Leader

BNB still rules the roost. It holds 45.2% of the entire exchange token market cap, according to CoinGecko’s December 2025 data. Why? Because Binance isn’t just an exchange-it’s a whole universe. BNB powers BNB Chain, which handles over 3.2 million transactions daily. It’s used for staking, paying for gas fees, buying NFTs on Binance NFT, and even paying for services outside crypto like travel and food in some countries.

BNB’s tokenomics are aggressive. Every quarter, Binance burns 20% of its profits to destroy BNB tokens. As of Q3 2025, 45.6% of the original 200 million supply has been burned. That’s over 91 million tokens gone. The result? A shrinking supply and steady price pressure upward.

Users get up to 25% off trading fees just by holding BNB. Staking yields can hit 15% APY. And with over 87% of Binance users holding BNB for fee discounts, it’s the most adopted exchange token by far. But there’s a catch. After Binance’s $4.3 billion settlement with U.S. regulators in November 2024, BNB’s legal status is under scrutiny. Some analysts worry it could be classified as a security. That’s why 37% of BNB holders on Reddit say they’re worried about regulatory risk.

OKB: The Scarcity Play

OKB is BNB’s closest competitor, with 18.7% market share. But it plays a different game. Instead of burning a percentage of profits, OKX has a fixed supply of 21 million tokens-same as Bitcoin. And they burn 30% of profits to reduce the circulating supply. Since 2023, that’s cut OKB’s supply by 12.3%.

OKB gives you a 40% discount on trading fees-better than BNB’s 25%. It also unlocks OKX Earn, where you can earn up to 8.5% APY on staked OKB. But the real advantage is ecosystem growth. OKX Chain (OKC) now hosts 412 dApps, from DeFi protocols to gaming platforms. That’s more than most Layer 1 blockchains.

Dr. Garrick Hileman of Blockchain.com says OKB’s fixed supply model gives it stronger long-term scarcity than BNB’s burn system. That’s why institutional investors are increasing their OKB holdings. But there’s a downside: MiCA regulations in Europe have made OKB harder to offer in some countries. If you’re in the EU, you might not even see it listed on your local exchange.

BGB: The Asian Copy-Trading Powerhouse

BGB is the dark horse. It’s not the biggest, but it’s growing fastest. Bitget’s token jumped to 8.6% market share in 2025, thanks to one thing: copy trading. Over 63% of users in Southeast Asia now use BGB to follow top traders automatically. That’s a feature no other exchange token offers at this scale.

Bitget burns 50% of its revenue every quarter. As of November 2025, 2.5 billion BGB tokens have been burned. That’s more than GT and KCS combined. Holders get 20% fee discounts and up to 12% APY on staking. And with the launch of Morph blockchain in November 2025, BGB now powers 42 dApps with $847 million in total value locked.

Asian users love it. On BitKan, 78% of reviews praise BGB’s high yields and copy-trading tools. But outside Asia, adoption is slower. The interface is less intuitive for English speakers, and customer support is limited in Western languages. Still, analysts at Rzlt.io predict BGB will close the gap with BNB by 2027, especially as Binance pulls back in regions like Indonesia and Vietnam.

MX: The Altcoin King

If you trade obscure altcoins, MX is your token. MEXC offers 2,690 spot trading pairs-the most of any exchange. And if you hold MX, you get a 50% discount on trading fees. That’s the highest in the industry.

MEXC burns 50% of its revenue to buy back MX tokens. Since its launch, they’ve spent $487 million to buy and destroy MX. That’s more than Gate.io and KuCoin combined. The result? MX’s circulating supply has dropped 18% since 2023.

MX dominates in Latin America, where 51.4% of users hold it as their main exchange token. It’s also the top choice for traders who want the widest selection of new tokens. In Q4 2025 alone, MEXC added 187 new listings, many of them low-cap gems. But there’s a trade-off: MEXC’s interface is complex. New users report needing 8-12 hours just to get comfortable. And while the fee discount is great, the platform’s security track record isn’t as strong as Binance’s.

GT: The Middle East Contender

Gate.io’s GT token might not be flashy, but it’s quietly powerful. It’s the only exchange token with a regulatory license in Dubai (VARA), which gives it a strong foothold in the Middle East. GT holders get 20% fee discounts and access to GateChain, which lets you swap 18 major cryptocurrencies across chains without leaving the platform.

Gate.io burns 20% of its revenue quarterly. Since 2018, 1.8 billion GT tokens have been destroyed. That’s solid, but not as aggressive as BNB or MX. What sets GT apart is brand power. Their sponsorship of Oracle Red Bull Racing in Formula 1 boosted token visibility by 37% in late 2025, according to CoinGape.

Gate.io’s user base is loyal. On their own forums, 89% of users rate GT’s tokenomics positively. But non-Asian users complain about poor English documentation. If you’re in the U.S. or Europe, you’ll find GT easy to use-but hard to learn without help.

KCS: The Security-Focused Token

KuCoin’s KCS stands out because it’s built for safety. Every day, 50% of trading fees go toward burning KCS. By December 2025, 387 million tokens had been destroyed. That’s a steady, predictable reduction in supply.

KCS gives you 20% fee discounts and access to KuCoin’s $2 billion protection fund-the largest in the industry. That fund kicks in if the exchange gets hacked. It’s why 89% of positive reviews mention security as the top reason they hold KCS.

KuCoin also leads in user-friendly features. You can link Apple Pay to your KuCard, use AI trading bots, and launch tokens through their GemSlot program. Since January 2025, 317 new tokens have been launched via GemSlot, with 47% higher average liquidity than non-participating ones.

But KCS has a weakness: reliability. After KuCoin’s service outage in February 2025, user sentiment dropped 42%. It recovered by April, but the incident exposed how dependent KCS is on KuCoin’s operational stability. If the exchange goes down, so does your access to KCS benefits.

Which One Should You Hold?

Here’s a quick guide to choosing:

- Hold BNB if you trade heavily on Binance and want maximum ecosystem access. Just be aware of regulatory risks.

- Hold OKB if you care about scarcity and want access to a growing DeFi ecosystem. Avoid if you’re in Europe and face MiCA restrictions.

- Hold BGB if you’re in Asia and use copy trading. It’s the best token for passive trading strategies.

- Hold MX if you trade altcoins and want the biggest fee discount. Be ready for a steep learning curve.

- Hold GT if you’re in the Middle East or want exposure to a regulated exchange with big brand backing.

- Hold KCS if security is your top priority. It’s the safest bet among the six.

None of these tokens are safe investments. They’re all tied to the performance of their parent exchange. If Binance gets shut down, BNB could crash. If OKX faces a hack, OKB will follow. That’s the risk. But if you’re active on these platforms, holding their native token isn’t just smart-it’s essential.

What’s Next for Exchange Tokens?

The next big shift? Decentralized governance. Delphi Digital predicts 68% of major exchanges will launch DAOs by 2027. That means token holders could vote on fee structures, listing decisions, and even CEO appointments. That’s a huge step toward legitimacy.

But regulators are watching. The SEC’s November 2025 guidance warned that exchange tokens could be classified as securities if their utility is too weak. That puts BNB, OKB, and KCS at risk if they don’t keep adding real-world use cases.

For now, the winners are the tokens that combine strong tokenomics, real utility, and aggressive burns. BNB still leads. But MX and BGB are closing in fast. If you’re holding one of these, make sure you understand how it works-and why it matters.

Are exchange tokens a good investment?

Exchange tokens aren’t traditional investments-they’re utility assets. Their value comes from how much you use the exchange. If you trade often, holding the token saves you money. If you don’t trade, it’s just another crypto holding with high risk. Don’t buy them expecting to get rich. Buy them to reduce fees and access platform perks.

Can I stake exchange tokens for passive income?

Yes, all six major exchange tokens offer staking. BNB gives up to 15% APY, OKB averages 8.5%, BGB offers 12%, and KCS has reliable 6-9% yields. But staking rewards are tied to the exchange’s profitability. If trading volume drops, so do your rewards. Always check the current APY on the exchange’s official site before locking up your tokens.

Do I need to hold the token to trade on these exchanges?

No, you can trade without holding the token. But you’ll pay full trading fees-often 0.1% or more. Holding the token can cut that to 0.05% or even 0.02%. For active traders, that adds up to hundreds or thousands of dollars in savings per year. It’s not required, but it’s financially smart.

What happens if the exchange gets hacked?

Most major exchanges now have protection funds. KuCoin’s is $2 billion. Binance has a SAFU fund. OKX and MEXC also have reserve pools. These funds are meant to cover losses if a hack occurs. But they don’t guarantee you’ll get your tokens back immediately. The exchange’s response time matters more than the fund size. Always enable two-factor authentication and avoid keeping large amounts on any exchange.

Are exchange tokens regulated?

Regulation is changing fast. Since January 2025, European exchanges under MiCA must publish monthly proof-of-reserves. That means you can verify the exchange actually holds the tokens it claims. The SEC in the U.S. is also looking at whether exchange tokens are securities. If they’re seen as investment contracts, they could be restricted or banned. BNB and OKB are under the most scrutiny right now.

How do I know if a token burn is real?

Look for public burn trackers. Binance, OKX, and Gate.io all have live dashboards showing burned tokens in real time. MEXC and KuCoin publish monthly reports. Bitget shares burn data on its transparency page. If an exchange doesn’t show verifiable burn records, don’t trust their claims. Real burns are public, on-chain, and time-stamped.

Naman Modi

December 20, 2025 AT 07:22Melissa Black

December 20, 2025 AT 22:23Helen Pieracacos

December 22, 2025 AT 18:22Sophia Wade

December 23, 2025 AT 20:20Alison Fenske

December 24, 2025 AT 00:16Rachel McDonald

December 25, 2025 AT 22:35Amit Kumar

December 27, 2025 AT 08:58Vijay n

December 27, 2025 AT 23:21Rebecca F

December 28, 2025 AT 01:31chris yusunas

December 29, 2025 AT 04:02Dustin Bright

December 29, 2025 AT 16:36Kevin Karpiak

December 31, 2025 AT 14:06Mmathapelo Ndlovu

January 1, 2026 AT 19:56Tyler Porter

January 2, 2026 AT 01:58Rishav Ranjan

January 3, 2026 AT 15:09Steve B

January 4, 2026 AT 20:45Grace Simmons

January 5, 2026 AT 12:23Brian Martitsch

January 5, 2026 AT 18:39