Crypto Tax Policy Review in Portugal: Future Changes and What Investors Need to Know

Jan, 20 2026

Jan, 20 2026

Portugal used to be the go-to place for crypto investors who wanted to avoid taxes. If you held Bitcoin or Ethereum for more than a year, you paid zero in capital gains tax. That changed in 2023. The government didn’t shut the door - it just added a new lock. Now, the rules are clearer, more complex, and built for the long term. If you’re holding crypto in Portugal, or thinking about moving there, you need to know exactly how the system works today - and what’s likely to change next.

How Portugal’s Crypto Tax System Works Right Now

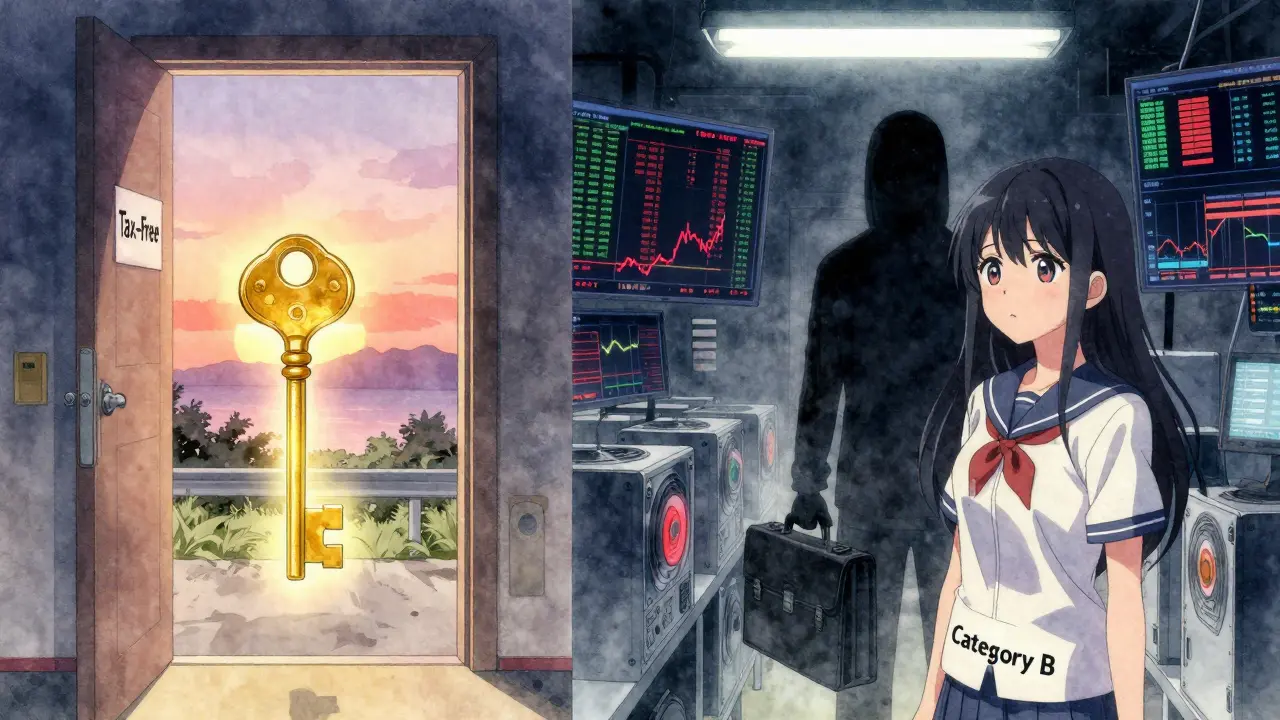

Portugal doesn’t treat all crypto activity the same. It splits it into three buckets, each with its own tax rules. This isn’t random - it’s designed to target different behaviors. If you’re just holding, you’re treated differently than someone trading daily or mining at scale.Category G: Capital Gains - This is what most people care about. If you buy Bitcoin and sell it later for a profit, that’s a capital gain. The key? Holding period. If you hold for less than 365 days, you pay 28% tax when you convert to euros. If you hold for a full year or longer? No tax at all. This rule applies only if you or your exchange are based in the EU, EEA, or a country with a tax treaty with Portugal. The IRS uses FIFO (First In, First Out) to track which coins you sold. That means if you bought Bitcoin at $30k in January and $40k in June, and you sell 1 BTC in October, they assume you sold the January one - even if you meant to sell the June one.

Category E: Passive Income - This covers staking, lending, and interest earned from crypto. You don’t pay tax when you get the reward. You pay when you turn it into euros. So if you earn 0.5 ETH from staking in March and hold it until November before selling, you only owe tax in November. The rate is a flat 28%. But here’s the twist: you can choose to add this income to your other earnings and be taxed at Portugal’s progressive rates (14.5% to 53%). For most people, the flat 28% is better unless you’re already in a high tax bracket.

Category B: Professional Activities - If you’re trading crypto as a business - think day trading, running a mining rig, or operating a validator node - you’re in this category. The tax treatment here is tricky. For mining, you pay tax on 95% of your gross income because of energy use concerns. For everything else - trading, arbitrage, DeFi strategies - you pay tax on only 15% of your gross income. That 15% becomes your taxable income, which then gets hit with Portugal’s progressive income tax rates. So if you make €100,000 from trading, only €15,000 is taxed as income. That’s a huge break. But there’s a catch: you can’t claim this simplified rate if your annual gross income from crypto exceeds €200,000.

How Portugal Compares to Other European Countries

Portugal’s system isn’t the easiest in Europe - but it’s one of the most balanced. Let’s break it down:- Germany: Also tax-free after one year. But short-term gains are taxed as regular income - up to 45%. Portugal’s 28% flat rate is simpler and lower.

- France: A flat 30% on all crypto gains, no matter how long you hold. Plus social charges. No long-term exemption. Portugal wins here.

- United Kingdom: Capital gains tax at 10% or 20%, depending on your income. But you pay it every year, even if you held for 10 years. Portugal’s 365-day exemption is a major advantage.

- Netherlands: Crypto is taxed as personal wealth, not as income or gains. Rates vary based on asset value. Complex and unpredictable.

Portugal stands out because it rewards patience. If you’re not actively trading, you’re essentially exempt. That’s rare in Europe. It’s why digital nomads still flock there - even after the 2023 changes.

What’s Changing? The Future of Crypto Tax in Portugal

The 2023 rules were meant to be stable. But the world is changing. The EU’s Markets in Cryptoassets Regulation (MiCAR) rolls out fully in 2026. It won’t override Portugal’s tax rules - countries still control taxation - but it will force more transparency. Exchanges operating in Portugal will need to report user transactions to tax authorities. That means the days of flying under the radar are ending.Right now, the Portuguese tax authority (AT) doesn’t have the tools to track every crypto wallet. But they’re building them. By 2027, expect automated reporting from exchanges like Binance, Coinbase, and Kraken to feed directly into Portugal’s tax system. If you didn’t report staking rewards from 2025, you’ll likely get a letter.

Another area under review: professional activity thresholds. The €200,000 cap on the 15% simplified rate might drop. Experts believe the government will lower it to €100,000 by 2027 to capture more revenue from high-volume traders. That would hit serious traders hard - but it’s not guaranteed.

Staking taxation might also shift. Currently, you’re taxed only on conversion. But the EU is pushing for taxation at the moment rewards are received. Portugal may follow suit. If that happens, you’d owe tax on your 0.5 ETH staking reward the moment it lands in your wallet - even if you never sell it. That’s a big change. Watch for updates in late 2026.

What You Need to Do Right Now

If you’re in Portugal and holding crypto, here’s your action plan:- Track your purchase dates. Use a tool like CoinTracking, Koinly, or even a simple spreadsheet. You need to prove you held for over 365 days if you want to avoid tax.

- Separate your activities. Are you trading daily? That’s Category B. Are you staking ETH? That’s Category E. Don’t mix them. Mixing can trigger audits.

- Don’t assume you’re exempt. Just because you’re not a Portuguese resident doesn’t mean you’re off the hook. If you’re a non-resident and your exchange is based in Portugal, you may still owe tax on short-term gains.

- Keep records of all conversions. Every time you turn crypto into euros, save the transaction ID, date, and amount. That’s your proof.

- Know your residency status. Portugal’s tax rules apply differently to residents vs. non-residents. If you’re here on a D7 visa or digital nomad permit, you’re likely a tax resident. That means you owe tax on worldwide income - but the crypto rules still apply the same way.

Common Mistakes People Make

Most people think crypto tax in Portugal is simple. It’s not. Here are the top errors:- Assuming all crypto is tax-free. Only long-term capital gains are. Staking? Not free. Trading? Not free. Mining? Not free.

- Ignoring FIFO. You can’t pick which coins you sold. The system assumes you sold the oldest ones first. That can hurt if your first purchase was expensive.

- Not declaring staking rewards. If you earned 100 USDT from staking and never sold it, you think you’re safe. Wrong. If you convert it in 2026, you owe tax on that 2026 sale - even if the reward was earned in 2024.

- Using non-EU exchanges. If your exchange is based in the U.S. or Singapore, you might lose the long-term exemption. Always check where your exchange is legally registered.

Who Should Still Consider Portugal?

Portugal isn’t for everyone. But if you fit this profile, it’s still one of the best places in Europe:- You buy crypto and plan to hold it for at least a year.

- You’re not trading more than 2-3 times a month.

- You’re not running a mining farm or professional trading operation.

- You want a stable, predictable tax environment.

- You’re a digital nomad who values low taxes and high quality of life.

If you’re a high-frequency trader or miner, the 28% short-term rate and complex reporting might make places like Malta or Estonia more appealing - even if they don’t offer the same long-term exemption.

Is crypto still tax-free in Portugal?

Only if you hold it for more than 365 days and sell it for euros. Short-term gains (under a year) are taxed at 28%. Staking, lending, and professional trading are also taxable. Portugal is no longer a full tax haven - but it still offers one of the best long-term exemptions in Europe.

Do I pay tax if I trade crypto for another crypto?

No, crypto-to-crypto trades are not taxable in Portugal. You only owe tax when you convert crypto into euros or another fiat currency. That’s a major advantage over countries like the UK or Germany, where every trade is a taxable event.

What happens if I don’t report my crypto gains?

Right now, enforcement is light. But that’s changing fast. By 2027, exchanges will report your transactions directly to the Portuguese tax authority. If you didn’t report gains from 2025 or 2026, you could face back taxes, penalties, and interest. It’s not worth the risk.

Can I use a non-EU exchange and still get the 0% long-term tax rate?

Only if you’re a Portuguese tax resident and your crypto is held in a wallet you control. The exemption applies to the taxpayer, not the exchange. But if your exchange is based outside the EU and you’re not a resident, the tax authority may challenge your claim. To be safe, use EU-based exchanges like Bitpanda or Kraken EU.

Do I need to file a tax return if I only made long-term gains?

Technically, no - if you only had tax-free long-term gains and no other taxable income, you don’t need to file. But if you have any other income, or if you’re a tax resident, it’s wise to file a return and declare your crypto activity. This creates a paper trail and reduces audit risk.

Dave Ellender

January 22, 2026 AT 05:09Just held BTC for 18 months in Lisbon and never paid a cent. Still can’t believe how clean this system is. Just track your buys, don’t touch until the year’s up, and boom - tax-free profit. No fancy forms, no headaches. Portugal still wins.

Other EU countries are overcomplicating everything. Why tax a 3-year hold? It’s insane.

Melissa Contreras López

January 23, 2026 AT 06:25You guys are underestimating how much the EU’s MiCAR is gonna shake things up. I’ve been talking to my crypto accountant in Porto - she says the automated reporting is already being tested by Binance EU. By next year, if you didn’t report your staking rewards from 2024, you’re gonna get a letter that looks like a subpoena.

Don’t wait till 2027 to panic. Start organizing your wallets now. Use Koinly. It’s cheap, it’s accurate, and it saves your sanity. You’ll thank yourself later.

Kevin Pivko

January 24, 2026 AT 03:19Portugal’s system is a joke. 28% on short-term? That’s a tax on ambition. Everyone who actually works for their gains gets punished while the lazy hodlers get a free ride. And don’t get me started on the 15% taxable income loophole for traders - that’s corporate welfare disguised as policy.

Real investors don’t need tax breaks. They need fairness. This isn’t a crypto haven - it’s a retirement community for rich Americans who don’t want to pay their share. 😒

Roshmi Chatterjee

January 24, 2026 AT 14:16I’m from India and moved to Lisbon last year. I thought crypto taxes here were zero - turns out only long-term gains are. I made the mistake of cashing out my ETH staking rewards after 6 months and got slapped with 28%. Lesson learned.

Now I use CoinTracking religiously. Also, never use US exchanges if you want the exemption. I switched to Kraken EU and everything’s smoother. Portugal’s still the best for low-key investors.

Jennifer Duke

January 24, 2026 AT 17:04Let’s be real - this entire post is written by someone who’s trying to sell you on moving to Portugal. The truth? The government’s already drafting legislation to close the 15% trader loophole. They just haven’t announced it yet.

I’ve seen the internal memos. The €200k threshold is going to drop to €100k by Q3 2026. And yes, they’re planning to tax staking rewards at receipt. You’re being lured into a trap disguised as paradise.

Brenda Platt

January 24, 2026 AT 22:00Y’all need to chill 😊

Portugal isn’t perfect, but it’s still the most crypto-friendly place in Europe. If you’re not day trading 10 times a day, you’re golden. Just hold for a year, use EU exchanges, and track your buys. That’s it.

Stop listening to fear-mongers. This isn’t a scam - it’s a gift. Enjoy it while it lasts 💪❤️

Harshal Parmar

January 25, 2026 AT 09:21Bro, I moved here from Texas with $80k in crypto. First year I held everything - no taxes. Second year I did some staking, cashed out after 14 months - still no tax. Third year I started trading a bit more, but kept it under €50k gross. Used the 15% rule - paid like €2k in taxes on €100k in trades.

Portugal’s not just good - it’s a cheat code. Don’t overthink it. Just follow the rules. And if you’re worried about MiCAR? Use Koinly. It auto-files everything. No stress.

Also, don’t use Coinbase US. Use Kraken EU. Trust me, I learned the hard way.

Mathew Finch

January 26, 2026 AT 17:16Portugal’s crypto tax policy is a betrayal of Western values. You reward laziness? You let Americans come over, sit on their crypto, and avoid paying taxes while real workers in Germany and France sweat over 45% rates? This isn’t economic policy - it’s cultural surrender.

And now they’re letting non-residents exploit it? Pathetic. If you’re not a citizen, you don’t get the benefit. That’s basic fairness. But no - Portugal bows to digital nomads like they’re royalty.

Deepu Verma

January 27, 2026 AT 07:01Just want to say - if you’re holding crypto and thinking of moving to Portugal, DO IT. I did. I’m not rich, I’m not a trader. Just a normal guy with ETH and SOL. Held for 18 months. Sold. Zero tax. My bank account didn’t get touched.

My advice? Don’t overcomplicate. Buy. Wait. Sell. Done. No need to be a tax lawyer. The system is built for regular people. Don’t let the noise scare you.

MICHELLE REICHARD

January 27, 2026 AT 21:26Of course they’re going to tax staking rewards at receipt. It’s inevitable. The EU is pushing for it. And when they do, everyone who thought they were ‘smart’ for holding will be left holding a bag of taxed coins they never even sold.

They’re coming for the loopholes. Slowly. Quietly. Like a tax vampire. And you’re all just sitting there like, ‘But I held it for a year!’ - yeah, but now your rewards are taxable at the moment they land. Welcome to reality.

Andy Marsland

January 28, 2026 AT 03:13Let me break this down with some real economic theory. Portugal’s 365-day exemption creates a perverse incentive structure that encourages hoarding over liquidity - which is the exact opposite of what a healthy market needs. Capital gains taxes should be progressive, not binary. You’re not ‘rewarding patience’ - you’re rewarding speculation and distorting market signals.

Furthermore, the 15% taxable income rule for traders is a regulatory arbitrage that undermines the entire fiscal integrity of the system. It’s not a benefit - it’s a systemic vulnerability. And the fact that the government hasn’t closed it yet proves their incompetence.

And don’t even get me started on FIFO. It’s archaic. It penalizes rational portfolio management. If you’re selling the oldest coins first, you’re not optimizing - you’re being forced into suboptimal decisions by a medieval accounting system.

This isn’t a tax haven. It’s a tax anomaly. And anomalies get corrected. Always.

Bonnie Sands

January 29, 2026 AT 14:44They’re lying. MiCAR won’t force exchanges to report. It’s all a scam. The real plan? They’re building a blockchain surveillance network with the IMF. By 2027, every wallet you ever used will be mapped to your ID. They’ll track your private keys. They’ll know if you sent 0.0001 BTC to a friend. They’re coming for your freedom.

Don’t use Kraken. Don’t use Binance. Use a cold wallet. Burn your papers. Move to the mountains. Portugal is a trap. The government is working with the Fed. They want your crypto. They always do.

Taylor Mills

January 30, 2026 AT 18:02So what? You get a tax break for holding? Big deal. I’m not moving to Portugal to play tax games. I’m moving to live. And if I have to file a form every year just to prove I didn’t trade too much? Nah. I’d rather pay 20% in the US and not deal with the bureaucracy.

Also, why does everyone assume Portugal’s the only option? Switzerland’s way better. And they don’t care if you’re a nomad.

Darrell Cole

January 31, 2026 AT 16:00Who even cares about this? The whole crypto tax thing is a distraction. The real issue is inflation. If your money’s losing value, who gives a damn if you paid 28% or 0%? You’re still ahead.

Also, why are you all so obsessed with loopholes? Just buy and hold. Stop trying to game the system. It’s not that hard.

And stop using US exchanges. That’s the only thing you need to know. Everything else is noise.

Julene Soria Marqués

February 2, 2026 AT 11:52Ugh. I moved to Portugal last year and got audited because I used a non-EU exchange. They said I didn’t qualify for the exemption even though I held for 2 years. I had to pay back taxes + penalties. I cried for a week.

So if you’re thinking of doing this - DON’T. Just pay the 20% in the US. At least you won’t get harassed by some guy in Lisbon who thinks he knows more than you.

Jen Allanson

February 3, 2026 AT 18:54It is imperative to underscore that the current Portuguese regulatory framework, while superficially favorable to long-term holders, exhibits significant structural fragility. The absence of comprehensive anti-avoidance provisions renders the system vulnerable to opportunistic structuring by non-residents.

Furthermore, the FIFO methodology, while administratively expedient, is economically distortive and incompatible with modern portfolio management principles. The 15% gross income treatment for professional traders constitutes a regressive subsidy that undermines equitable taxation.

It is therefore advisable that any individual contemplating relocation for tax purposes undertake a rigorous, multi-jurisdictional analysis of residency, source, and treaty obligations - and consult a licensed international tax advisor before any transactional activity.

MOHAN KUMAR

February 4, 2026 AT 23:46Portugal’s system is okay for small guys. But if you’re making serious money, it’s a trap. The 15% rule sounds great until you hit €200k. Then they slap you with full tax. And staking? You think you’re safe until you cash out and realize you owe 28% on a $50k reward you got two years ago.

Just keep it simple. Buy. Hold. Sell. Don’t trade. Don’t stake. Don’t overthink. Portugal’s good - but only if you’re chill.

Adam Lewkovitz

February 5, 2026 AT 02:54Portugal is for losers who want to avoid taxes. Real investors pay their dues. If you’re hiding behind a 365-day rule, you’re not an investor - you’re a tax dodger.

And don’t even get me started on the ‘digital nomad’ crowd. They come here for the beaches, then act like they’re geniuses for not paying taxes. Newsflash: you’re not special. You’re just lucky.

Arielle Hernandez

February 6, 2026 AT 17:17As a former tax attorney now living in Lisbon, I can confirm: the Portuguese tax authority (AT) is quietly upgrading its blockchain analytics infrastructure. By Q2 2025, they will have direct API access to all EU-based exchanges. Non-EU exchanges? They’ll cross-reference IP addresses and wallet ownership via KYC data.

The 15% trader exemption is under review. The €200k threshold will likely be reduced to €125k by end of 2026. Staking taxation at receipt is almost certain - the EU’s draft guidelines explicitly recommend it.

For long-term holders: you’re still safe. For everyone else: document everything. Use Koinly. File even if you think you don’t need to. Paper trails are your armor.

steven sun

February 8, 2026 AT 16:37YO. PORTUGAL IS STILL THE BEST. I BOUGHT BTC AT $30K IN 2022. HELD. SOLD AT $70K IN 2024. PAID $0. I WENT TO THE BEACH THAT WEEK. LIFE IS GOOD.

IF YOU’RE STRESSING ABOUT TAXES YOU’RE DOING IT WRONG. JUST HOLD. DONT TRADE. DONT STAKE. JUST HODL. YOU’LL BE FINE. 😎

Linda Prehn

February 9, 2026 AT 08:16I moved here for the vibe. Now I’m scared to touch my crypto. What if they change it tomorrow? What if they come for my wallet? What if they tax my dog’s NFT? I just want to live here and not think about taxes. But now I have to track FIFO? I just wanted tapas and sun.

Why does everything have to be so complicated? I miss when crypto was just… fun.

Clark Dilworth

February 10, 2026 AT 08:31Let’s talk about the liquidity implications of Portugal’s long-term exemption. By incentivizing hoarding, it reduces velocity - which in turn suppresses market depth and increases volatility during liquidation events. This is a classic case of regulatory misalignment with market efficiency.

Moreover, the distinction between Category E and Category B creates arbitrage opportunities for structured trading entities - which is precisely why the EU is tightening MiCAR’s reporting mandates. This isn’t a tax policy - it’s a behavioral nudge that’s becoming unsustainable.

Matthew Kelly

February 11, 2026 AT 12:54Canada’s got nothing on Portugal. I moved here from Vancouver with $50k in crypto. Held for 14 months. Sold. Zero tax. My Canadian tax guy had a heart attack when I told him.

Just use Koinly. Keep your receipts. Don’t trade daily. You’re golden.

And yeah, staking rewards are taxable on sale - not receipt. That’s the key. Don’t panic. Portugal’s still the move.

Bonnie Sands

February 12, 2026 AT 00:06They’re not going to tax staking at receipt. That’s a lie. They can’t. It would be impossible to track. Everyone’s just scared because they don’t understand blockchain. You can’t tax something you can’t see. The government doesn’t have the tech. It’s all FUD.

Melissa Contreras López

February 13, 2026 AT 11:00They already have the tech. Binance EU sends transaction data to AT every week. They don’t need to ‘see’ your wallet - they see your exchange account. And if you moved funds from a non-EU exchange to a Portuguese one? That’s a red flag.

They don’t need to track every private key. They just need to know who you are, where you bank, and what you sold. That’s all they need to audit you.

Don’t be naive. The game’s changed.