Cryptocurrency Tax Reporting Rules for 2025: What You Must Know

Feb, 9 2026

Feb, 9 2026

When you trade Bitcoin, earn staking rewards, or even receive a free NFT, the IRS sees it as a taxable event-no matter how small. There’s no minimum threshold anymore. Not $100. Not $20. Not even $1. If you moved crypto in 2024, you owe taxes on it. And starting in 2025, the IRS is finally making it harder to ignore.

Why Crypto Isn’t Just ‘Digital Money’

The IRS doesn’t treat cryptocurrency like cash. It treats it like stocks, real estate, or gold. That means every time you sell, trade, or spend crypto, you’re triggering a capital gain or loss. Even if you swap Bitcoin for Ethereum, that’s a taxable sale. You’re not just moving money-you’re selling one asset and buying another.Here’s how it breaks down:

- If you hold crypto for less than a year before selling or trading, it’s a short-term capital gain-taxed at your regular income rate, up to 37%.

- If you hold it for more than a year, it’s a long-term capital gain-taxed at 0%, 15%, or 20%, depending on your income.

- If you earn crypto as a reward (like from staking, mining, or airdrops), it’s ordinary income-taxed at your full income rate based on its value when you received it.

That $500 worth of SOL you got from staking? Taxed as income. The $200 ETH you traded for DOT? Taxable gain. Even the free $100 in tokens from a project’s airdrop? You owe taxes on it. No exceptions.

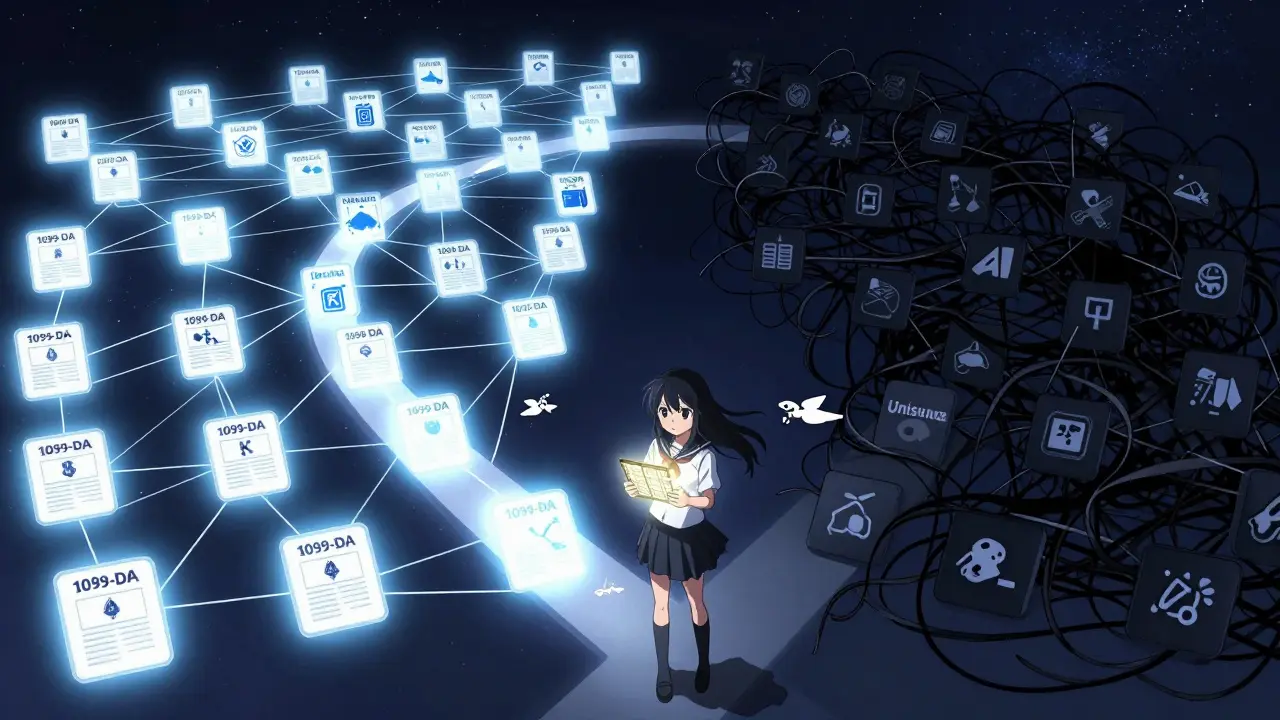

The Big Change: Form 1099-DA

Before 2025, crypto tax reporting was a mess. Some exchanges sent you a Form 1099-K if you made over $20,000. Others didn’t send anything. You had to track every single trade across Coinbase, Kraken, Binance, and your own wallet-by hand. Most people didn’t. That’s why the IRS estimates $50 billion in crypto taxes go unpaid every year.Starting January 1, 2025, all centralized crypto exchanges and brokers (like Coinbase, Kraken, Gemini) must report your trades using a new form: Form 1099-DA. This isn’t optional. It’s law.

Here’s what it reports:

- Gross proceeds (starting Jan 1, 2025): The total amount you received when you sold or exchanged crypto. If you sold 1 BTC for $65,000, they report $65,000-even if you bought it for $40,000.

- Cost basis (starting Jan 1, 2026): The original value of what you bought, plus fees. If you bought 1 ETH for $1,500 and paid $50 in gas fees, your cost basis is $1,550.

This is huge. For the first time, the IRS will have a clear record of your crypto activity. No more guessing. No more hiding. If you sold crypto in 2025, the IRS will know exactly how much you made-before you even file your return.

What’s Still Not Reported

Form 1099-DA doesn’t cover everything. It only applies to centralized platforms that hold your crypto. That means:- DeFi protocols (like Uniswap, Aave, or Curve) don’t report anything.

- Wallets you control (MetaMask, Ledger, Trezor) aren’t tracked.

- P2P trades on platforms like Bisq or LocalCryptos aren’t reported.

And here’s the catch: you still have to report these yourself. Just because the exchange doesn’t report it doesn’t mean the IRS doesn’t care. In fact, the IRS is now using blockchain analysis tools to trace transactions across wallets. They’ve already matched 83% of anonymized crypto movements to real people in pilot tests.

President Trump signed a law on April 10, 2025, officially removing reporting rules for DeFi platforms. That was a win for privacy-but it doesn’t mean DeFi is tax-free. It just means you’re on the hook to track it all yourself.

How to Report: The Forms You Need

You can’t just check a box anymore. You need to file these forms:- Form 8949: Lists every crypto sale or trade, including date bought, date sold, cost basis, and proceeds.

- Form Schedule D: Summarizes your total capital gains and losses from Form 8949.

- Form Schedule 1 (1040): Reports crypto income from staking, airdrops, or payments.

- Form Schedule C: If you run a business and get paid in crypto (like a freelancer or merchant), use this.

And yes, there’s still a question at the top of your 1040 form:

"At any time during [year], did you (a) receive (as a reward, award, or payment for property or services); or (b) sell, exchange, gift, or otherwise dispose of a digital asset (or a financial interest in a digital asset)?"

Answer "Yes," even if you didn’t make money. Answer "No," and you’re lying under penalty of perjury.

What Happens If You Don’t Report?

The IRS isn’t asking nicely anymore. They’re auditing.Since 2016, they’ve issued over 10,000 summonses to crypto exchanges for user data. Coinbase alone gave up records for 14,000 accounts. In 2024 alone, the IRS conducted 1,200 crypto audits. And they’re not stopping.

Penalties for underreporting crypto are brutal:

- 25% penalty for underpayment due to negligence.

- 75% penalty for fraud or intentional evasion.

- Interest that compounds daily.

- Criminal charges for tax evasion-up to 5 years in prison.

One man in Texas got audited after he traded $120,000 in crypto across 12 wallets. He didn’t report any gains. He owed $48,000 in taxes, $32,000 in penalties, and $11,000 in interest. He went to jail.

What You Should Do Right Now

If you’ve traded crypto at all since 2020, here’s your action plan:- Collect all transaction history from every exchange and wallet you’ve used. Export CSV files.

- Use crypto tax software like Koinly, CoinTracker, or TokenTax. They auto-calculate gains, losses, and cost basis. Most cost under $100 for the year.

- Separate income from gains. Staking rewards? Income. Trading BTC for ETH? Capital gain.

- Don’t ignore DeFi. Even if it’s not reported, you still owe taxes on rewards, swaps, and liquidity pool earnings.

- File by April 15, 2026 for 2025 taxes. If you’re overseas, you get until June 15. Extensions? October 15.

Most people don’t realize they’re supposed to report every transaction. A 2024 University of Chicago study found 87% of crypto users didn’t know their full tax obligations. Don’t be one of them.

The Future: More Enforcement, Less Room to Hide

The IRS has poured $1.2 billion into crypto enforcement in 2025. That’s 10% of their entire enforcement budget. They’ve created a dedicated Virtual Currency Enforcement Team. They’re signing new tax treaties with Switzerland, Singapore, and other crypto hubs to share data.By 2026, when Form 1099-DA starts reporting cost basis, the IRS will have a complete picture of your crypto activity. That’s when errors will drop by 60%, and tax revenue from crypto is expected to jump by $12.3 billion a year.

There’s no turning back. The era of "I didn’t know I had to report it" is over. The IRS has the tools, the data, and the will to catch you. The only question left is: are you ready?

Do I have to report crypto if I didn’t sell it?

Yes-if you received crypto as income (staking, airdrops, payments), you must report it at its fair market value on the day you received it. Just holding crypto without selling or trading it doesn’t trigger a tax event, but any movement-like swapping one coin for another-counts as a sale.

What if I lost money trading crypto?

You still report the trades. Losses can offset gains, and if you have more losses than gains, you can deduct up to $3,000 per year from your ordinary income. Any extra losses carry forward to future years.

Do I need to report crypto on my business taxes?

Yes. If your business accepts crypto as payment, that income is taxable. If you sell crypto held as a business asset, it’s treated as inventory-gains are taxed as ordinary income, not capital gains. You must report this on Form Schedule C.

Can I use tax software to file crypto taxes?

Yes. Tools like Koinly, CoinTracker, and TokenTax connect to your wallets and exchanges, auto-calculate your gains and losses, and generate IRS-ready reports. They’re the easiest way to stay compliant without hiring an accountant.

What happens if I move crypto between my own wallets?

Nothing. Moving crypto between wallets you own-like from Coinbase to MetaMask-is not a taxable event. You only report it if you sell, trade, or spend it.

Is there a deadline for reporting 2025 crypto trades?

Yes. The deadline to file your 2025 tax return is April 15, 2026. If you’re outside the U.S., you get until June 15. You can request an extension until October 15, but you still owe any tax due by April 15 to avoid penalties.

monique mannino

February 9, 2026 AT 18:52