How DePIN Projects Work: Decentralized Physical Infrastructure Networks Explained

Feb, 19 2026

Feb, 19 2026

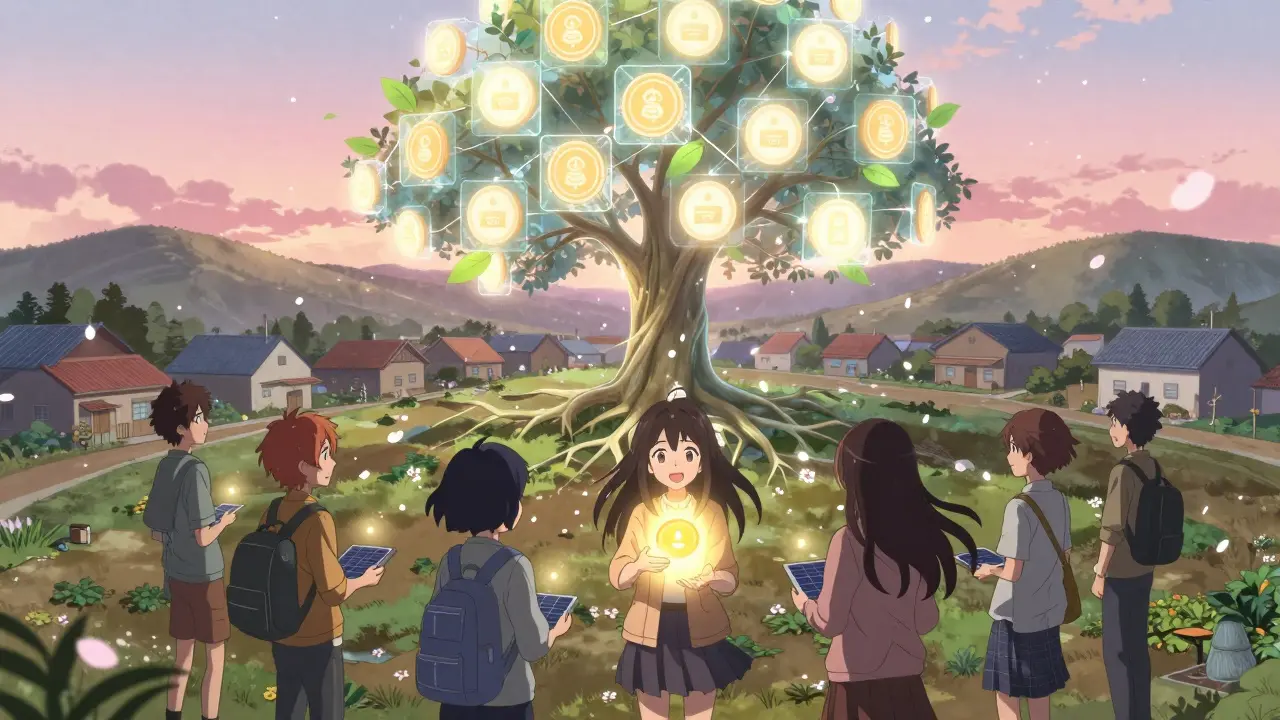

Imagine your neighbor installs a Wi-Fi hotspot in their living room - not to boost their own internet, but to earn cryptocurrency. Every time someone nearby uses that connection, they both get paid. No telecom company. No middleman. Just a simple device, a blockchain, and a shared incentive. This isn’t science fiction. It’s DePIN - Decentralized Physical Infrastructure Networks - and it’s already changing how the world builds and uses real-world infrastructure.

What Exactly Is DePIN?

DePIN stands for Decentralized Physical Infrastructure Networks. At its core, it’s a way to build and maintain physical infrastructure - like cell towers, solar panels, or data storage - using blockchain technology and cryptocurrency rewards. Instead of a company like AT&T or Amazon building and owning these systems, everyday people contribute their own resources and get paid in tokens for doing so.

Traditional infrastructure is centralized. One company owns the tower, controls the data, and sets the price. If they go down, the whole network goes down. DePIN flips that. Thousands of small contributors make up the network. If one goes offline, the rest keep working. There’s no single point of failure.

Think of it like Uber, but for physical infrastructure. Instead of a company owning cars, drivers use their own vehicles and get paid per ride. In DePIN, instead of a utility company owning power lines, homeowners with solar panels share excess energy and get paid. Or instead of a cloud provider like AWS owning data centers, you rent out spare hard drive space and earn crypto.

How DePIN Works: The Three Core Pieces

Every DePIN project runs on three interconnected parts: smart contracts, tokenization, and a distributed network.

- Smart contracts are self-executing rules written in code. They automatically handle payments, verify usage, and enforce rules - no human approval needed. If you provide 10GB of storage for a week, the contract checks the data, confirms it’s still there, and sends you tokens.

- Tokenization turns physical resources into digital assets. Your Wi-Fi hotspot isn’t just a device - it’s a tokenized asset on the blockchain. Every time someone uses it, the network records the transaction and rewards you. These tokens can be traded, held, or used to access other services in the network.

- Distributed network architecture means no central server or company controls the system. The infrastructure is spread across thousands of locations. Data, energy, bandwidth - it’s all owned and operated by the community.

The blockchain acts as the backbone: it’s the administrative system (who gets paid), the payment system (how tokens are sent), and the record-keeper (who did what, when). All of it is public, tamper-proof, and automated.

Two Types of DePIN Networks

Not all DePIN projects are the same. They fall into two clear categories based on what kind of resources they use.

Physical Resource Networks (PRNs)

These are tied to specific locations. The resources can’t be moved - they’re fixed in place.

- Wireless coverage: Helium’s hotspots provide LoRaWAN network coverage. You buy a hotspot, plug it in, and earn HNT tokens every time a device (like a smart meter or bike tracker) connects through it.

- Energy sharing: Homeowners with solar panels join networks to sell excess electricity. The blockchain records how much energy was produced, who used it, and how much they were paid in tokens.

- EV charging: Owners of home charging stations open them to the public. Drivers pay in crypto, and the owner earns tokens based on usage.

These networks solve real problems - like rural areas with no cell service or neighborhoods without EV chargers. Traditional companies won’t build there because it’s not profitable. DePIN makes it profitable for individuals.

Digital Resource Networks (DRNs)

These aren’t tied to location. The resources are fungible - meaning one unit is the same as another, no matter where it is.

- Storage: Projects like Filecoin let you rent out unused hard drive space. Your extra storage becomes part of a global decentralized cloud.

- Computing power: Golem Network lets you rent out your computer’s idle CPU or GPU. Someone needing to render a 3D animation or train an AI model pays you in tokens.

- Bandwidth: Some networks let you share your home internet connection. People in countries with slow or censored internet use these to access global services.

These networks compete directly with giants like Amazon Web Services or Google Cloud - but without the corporate overhead, data privacy risks, or price hikes.

Why People Participate: The Incentive Engine

Why would someone give away their bandwidth, energy, or storage? Because they get paid - and not just a little.

DePIN projects use tokenomics - the economic design of tokens - to create self-sustaining loops:

- Contributors earn tokens for providing resources - whether it’s a hotspot, a solar panel, or spare storage.

- Users pay tokens to access services - like connecting to a wireless network or renting cloud storage.

- Tokens increase in value as demand grows. More users = more payments = more demand for tokens = higher rewards for providers.

It’s a feedback loop. The more people join, the more useful the network becomes, which attracts even more users and providers. No venture capital needed. No ads. Just real value exchanged in real time.

Take Helium, for example. In 2021, it had around 100,000 hotspots. By 2025, it had over 1.2 million - mostly installed by regular people in basements, backyards, and small towns. These hotspots now cover over 70 countries. No telecom company spent a dollar on that. The users built it themselves.

The Big Advantages: Why DePIN Matters

DePIN isn’t just a new tech trend - it’s a fix for broken systems.

- No single point of failure: If a centralized server goes down, millions lose service. In DePIN, one hotspot failing doesn’t break the network. Thousands of others pick up the slack.

- Lower costs: No corporate overhead. No shareholder pressure. No monopoly pricing. DePIN networks are often 30-60% cheaper than traditional services.

- Global access: In places where infrastructure is lacking - rural India, remote parts of Africa, or islands in the Pacific - DePIN lets locals build what they need. No waiting for a government or corporation to act.

- Transparency: Every transaction is on the blockchain. You can see exactly who provided what, when, and how much they were paid.

- Ownership: You’re not just a customer - you’re a co-owner. Many DePIN projects give users voting power on upgrades and changes.

Compare this to traditional models. A telecom company builds a cell tower, owns it, charges you $80/month, and can shut it off if you miss a payment. With DePIN, you could install a hotspot for $200, earn $15/month in tokens, and have full control over when and how it operates.

Real-World Examples You Can Use Today

DePIN isn’t theoretical. It’s live, growing, and usable.

- Helium (now Helium Network): The original DePIN success. Over 1.2 million hotspots globally. Used by IoT devices for low-power, long-range communication. Earn HNT by hosting a hotspot.

- Filecoin: A decentralized storage network. Over 10 exabytes of storage contributed by users. Pay in FIL to store files - no Amazon, no Google. Power Ledger: Lets homeowners in Australia and Thailand trade solar energy peer-to-peer. Your surplus power becomes a digital token you can sell to neighbors.

- Golem Network: Rent out your PC’s unused processing power. Artists, researchers, and AI developers pay you in GLM to render graphics or run simulations.

- ChargerHelp!: A DePIN project for EV charging. Owners of home chargers list them on the network. EV drivers find, pay for, and use them - all in crypto.

These aren’t experiments. They’re operational networks with real users, real transactions, and real economic value.

How Governance Works: No Bosses, Just Votes

Who decides what happens next? In a normal company, it’s the CEO. In DePIN, it’s the community.

Most DePIN networks use decentralized governance. Token holders vote on proposals:

- Should we increase rewards for storage providers?

- Should we add support for a new type of device?

- Should we change the token distribution model?

Each token usually equals one vote. The more you contribute, the more tokens you earn - and the more say you have. This ensures the network evolves based on what users actually need, not what a boardroom thinks is profitable.

It’s not perfect - voter turnout can be low, and big token holders can dominate. But it’s still far more democratic than any corporation ever was.

What’s Next for DePIN?

DePIN is still young, but adoption is accelerating. In 2024, over $1.8 billion was invested in DePIN projects. By 2026, analysts expect over 10 million physical devices - from hotspots to solar inverters - to be part of DePIN networks.

It’s not about replacing every utility company tomorrow. It’s about giving people the tools to build what’s missing - in their own neighborhoods, their own countries, their own lives.

Imagine a future where:

- Your child’s school gets internet because 10 neighbors pooled their hotspots.

- Your town’s EV charging station is owned by the community, not a corporation.

- Your old laptop helps train AI models and earns you enough crypto to pay your electricity bill.

That future isn’t far off. It’s being built right now - one hotspot, one solar panel, one hard drive at a time.

Is DePIN just another crypto scam?

No. While some DePIN projects have failed or been poorly designed, the best ones are built on real, measurable utility. Helium, Filecoin, and Golem have been operating for years with millions of users and billions in value exchanged. The key is to look at what physical service is being provided - not just the token price. If people are paying to use the service, and providers are earning from it, it’s not a scam - it’s a functioning economy.

Do I need to be a tech expert to join a DePIN project?

Not at all. Most DePIN projects have simple apps and plug-and-play hardware. For example, Helium hotspots are about the size of a router. You plug it in, connect to Wi-Fi, and start earning. No coding. No setup. Just follow the instructions. The blockchain handles the rest.

Can DePIN replace my internet provider?

Not yet for high-speed home internet, but it can complement it. Helium’s LoRaWAN network is great for IoT devices, sensors, and low-bandwidth use - not streaming video. But for areas with no internet at all, DePIN wireless networks are already providing the first connection. In places like rural Kenya or Indonesia, DePIN networks are the only affordable option.

Are DePIN networks secure?

Yes - often more secure than centralized systems. Because data is distributed and encrypted across many devices, there’s no central server to hack. Smart contracts enforce rules without human error. Plus, every action is recorded on the blockchain, making fraud nearly impossible. That’s why governments and NGOs are starting to test DePIN for emergency communications and disaster response.

How do I start participating in a DePIN project?

Start by choosing a project that matches your resources. If you have spare Wi-Fi, try Helium. If you have extra hard drive space, look at Filecoin. If you have solar panels, check Power Ledger. Most have official websites with step-by-step guides. You’ll need a crypto wallet (like MetaMask), some initial funds to buy hardware (if needed), and a little patience. The first month might earn you $5-$20. After six months, many users earn $50+ monthly - with zero extra effort.