How Do Banks in India React When You Withdraw Crypto to Fiat?

Feb, 17 2026

Feb, 17 2026

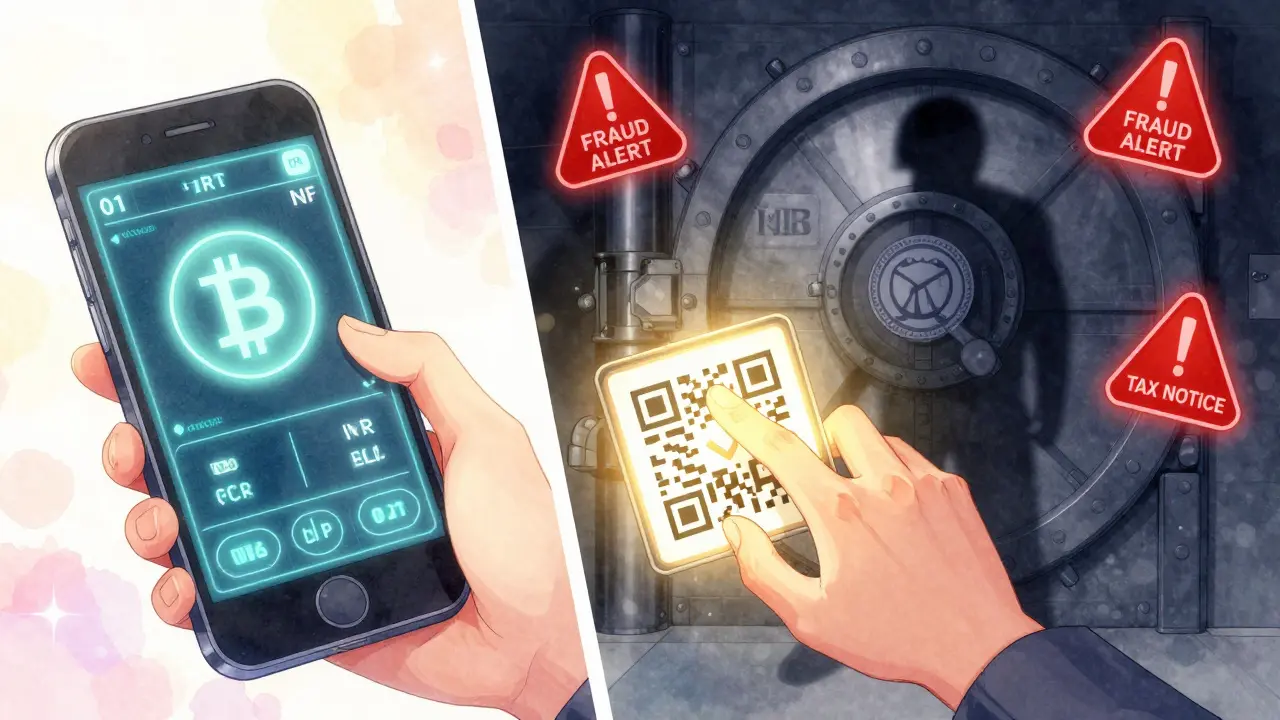

When you try to withdraw cryptocurrency to fiat currency in India, you’re not just making a simple bank transfer. You’re stepping into one of the most tightly controlled and confusing financial zones in the world. Even though owning and trading crypto is legal, banks in India don’t treat it like regular money. In fact, many will treat your crypto-to-fiat withdrawal like a red flag - not because it’s illegal, but because they’re scared of getting in trouble.

Legal? Yes. Welcome? Not Even Close

The Supreme Court of India overturned the Reserve Bank of India’s (RBI) 2018 ban on crypto banking services in 2020. That meant banks could legally open accounts for crypto exchanges again. Sounds simple, right? But here’s the catch: just because something is legal doesn’t mean banks want anything to do with it. Many still refuse to process crypto-related transactions, even if you’re just cashing out your Bitcoin into INR.

The RBI hasn’t reversed its stance. In fact, its leadership has doubled down. Former Governor Shaktikanta Das called crypto a threat to India’s financial system. Current Governor Sanjay Malhotra says the only digital currency India should care about is its own - the digital rupee (CBDC). He’s made it clear: "Cryptocurrencies have serious implications for monetary policy, capital account management, and anti-money laundering frameworks." That’s not a neutral statement. It’s a warning to banks: avoid crypto.

What Happens When You Withdraw Crypto to Fiat?

If you’re using a registered Indian crypto exchange like CoinDCX, WazirX, or ZebPay, the process looks smooth on the surface. You sell your crypto, request a bank transfer, and the money arrives in a few hours. But behind the scenes, there’s a whole system of checks you never see.

Here’s what actually happens:

- You must have completed full KYC - same as opening a bank account. That means government ID, proof of address, and a selfie.

- The exchange must have registered with the Financial Intelligence Unit (FIU-IND) under the Prevention of Money Laundering Act (PMLA). If they haven’t, your withdrawal won’t go through.

- Every transaction is flagged as a Virtual Digital Asset (VDA) transfer. Even if you’re withdrawing $50, the system logs your entire trade history, IP address, device ID, and wallet addresses.

- FIU-IND requires exchanges to report every single fiat withdrawal over ₹10,000 - but they monitor all transactions regardless of size.

- Your bank receives the deposit, but the transaction description might say something like "VDA Settlement - CoinDCX". That’s enough to trigger internal fraud alerts.

Some users report their bank freezing the account after a crypto withdrawal. Others get calls from their bank asking, "Where did this money come from?" That’s not a coincidence. Banks are under pressure from the RBI to treat crypto deposits as high-risk. Many now have automated filters that flag any incoming payment from a known crypto exchange.

Why Do Banks Care So Much?

It’s not personal. It’s institutional fear.

Banks in India are regulated by the RBI. If a bank processes crypto transactions and something goes wrong - say, a money laundering case or a tax evasion scandal - the RBI can fine the bank, suspend its operations, or even revoke its license. That’s why many banks have internal policies that outright ban crypto-related activity, even if the law doesn’t.

There’s also a real risk of reputational damage. In 2024, the FIU-IND publicly named 25 offshore exchanges - including BingX, LBank, and ProBit Global - for failing to comply with Indian AML rules. The government ordered these platforms to shut down their apps in India. That sent a clear message: if you work with crypto, you’re on the radar.

Banks don’t want to be associated with any platform that might get shut down next. So even if your exchange is compliant, your bank might still treat your withdrawal like a ticking time bomb.

The Tax Trap

India taxes crypto gains at 30%, with no deductions or offsetting losses. That’s harsher than most countries. But the bigger issue isn’t the tax rate - it’s the reporting.

Every crypto-to-fiat withdrawal must be reported to the Income Tax Department. The government has a direct data feed from crypto exchanges. They know exactly how much you sold, when, and for how much. If your bank sees a sudden deposit of ₹2.5 lakh and you’ve never filed a crypto tax return, they’re required to report it.

Many users don’t realize this: your bank and the tax department are sharing information. If your crypto withdrawal triggers a tax notice, your bank might freeze your account until you prove the funds are legitimate. You can’t just say, "It was from crypto." You need to show: trade history, wallet addresses, tax filings, and proof of payment.

What If Your Bank Blocks the Withdrawal?

If your bank refuses the deposit, here’s what actually works:

- Use a different bank. Some regional banks and newer digital banks (like Jupiter, Niyo, or RazorpayX) are more crypto-friendly.

- Withdraw to a UPI-linked wallet first, then transfer to your bank. UPI transactions are harder to flag because they don’t carry the same metadata.

- Split large withdrawals into smaller amounts over time. A ₹50,000 transfer is less likely to trigger alerts than ₹3 lakh in one go.

- Keep detailed records. Save screenshots of your trade history, wallet addresses, and tax filings. If your bank asks, you need proof - not just a story.

There’s no guaranteed solution. Some people switch banks entirely. Others use crypto-friendly payment aggregators like CoinSwitch or KoinX to manage their tax and bank reporting. But if you’re serious about withdrawing crypto to fiat in India, you need to treat it like a compliance project - not a bank transfer.

The Big Picture: What’s Coming Next?

India’s Parliament is working on new crypto legislation expected to pass in 2026. If it passes as drafted, SEBI will take over regulation of crypto exchanges. That means stricter rules, more audits, and possibly even licensing requirements - like brokers or mutual funds.

Meanwhile, the RBI is pushing its own digital rupee (CBDC) hard. It’s already live in pilot mode across multiple cities. The government’s message is clear: digital money is fine - as long as we control it.

For now, the system is a patchwork. Crypto is legal. Withdrawals are possible. But banks? They’re still waiting for clearer instructions. And until then, they’ll treat every crypto-to-fiat withdrawal like an audit waiting to happen.

What You Should Do Right Now

- Only use FIU-IND registered exchanges. Check their website - they must display their FIU registration number.

- Keep all trade records for at least 7 years. That’s the legal requirement for tax audits.

- File your crypto taxes on time. Even if you broke even, report it.

- Don’t use unregistered offshore exchanges. They’ll get blocked. And your money might disappear.

- If your bank asks questions, answer honestly - but have documents ready. A calm, prepared response works better than panic.

India’s crypto ecosystem is not broken. It’s just under heavy surveillance. If you play by the rules, you can still withdraw your crypto to fiat. But you can’t expect it to be easy. The system was designed to make it hard - not to stop you, but to make sure you can’t hide.

Can I withdraw crypto to fiat without using an exchange?

No. Direct peer-to-peer (P2P) crypto-to-fiat transfers between individuals are not supported by banks in India. Even if you find someone willing to buy your crypto for cash, the bank will flag the deposit as suspicious. All legal withdrawals must go through FIU-IND-registered exchanges that provide full audit trails and KYC verification. Attempting to bypass exchanges increases your risk of account freezing or tax scrutiny.

Do all banks in India block crypto withdrawals?

No, but many do. Public sector banks like SBI, HDFC, and ICICI have internal policies that discourage crypto transactions. Some private and digital banks - like Jupiter, Niyo, and RazorpayX - are more open, especially if the deposit comes from a registered exchange. Your best bet is to use a bank that has a history of processing payments from known Indian crypto platforms. Always check with your bank’s customer service before making a large withdrawal.

What happens if I don’t report my crypto gains?

The Indian Income Tax Department receives direct data from crypto exchanges. If you don’t report gains, you’ll likely get a notice. Penalties include 100% to 300% of the tax owed, plus interest. In serious cases, the department can initiate a criminal investigation under the PMLA. Even if you didn’t know the law, ignorance isn’t a defense. Always file your crypto taxes - even if you lost money.

Can I use UPI to withdraw crypto to fiat?

Yes - but only through approved exchanges. Some Indian exchanges allow you to withdraw fiat via UPI after selling crypto. This method is less likely to trigger bank flags because UPI transactions don’t carry the same metadata as traditional bank transfers. However, the exchange still reports the transaction to FIU-IND and the tax department. UPI doesn’t bypass regulation - it just makes the transfer smoother.

Why do some exchanges get blocked by the Indian government?

Exchanges are blocked if they fail to register with FIU-IND under the Prevention of Money Laundering Act (PMLA). In 2024-2025, 25 offshore platforms - including BingX and LBank - were ordered to shut down in India because they didn’t comply with KYC, AML, or transaction reporting rules. These platforms were handling over $20 billion in daily trades. The government’s message is clear: if you serve Indian users, you must follow Indian rules - or get blocked.

If you’re planning to withdraw crypto to fiat in India, treat this like a compliance task - not a banking request. The system isn’t designed to make it easy. But if you’re organized, honest, and prepared, you can still do it - without getting flagged.