NFT Value Explained: How Pricing Works & What Drives It

Mar, 18 2025

Mar, 18 2025

NFT Value Calculator

Impact Breakdown

Interpretation

Your NFT is valued at a moderate level based on the key factors. To improve value, consider increasing scarcity or utility, enhancing creator reputation, or strengthening community engagement.

Ever wondered why a digital image can sell for millions while another token sits untouched? The secret isn’t magic - it’s a blend of scarcity, demand, creator fame, and real‑world utility. This guide breaks down every factor that gives an NFT its worth and shows you how the market actually stamps a price on a token.

What an NFT Is (and Why It Matters)

NFT is a non‑fungible token, a unique digital asset stored on a blockchain that can’t be exchanged one‑for‑one like Bitcoin. Because each token has a distinct identifier, ownership is provable and immutable. That uniqueness is the foundation of value - if something can’t be copied, collectors are willing to pay for the exclusive rights.

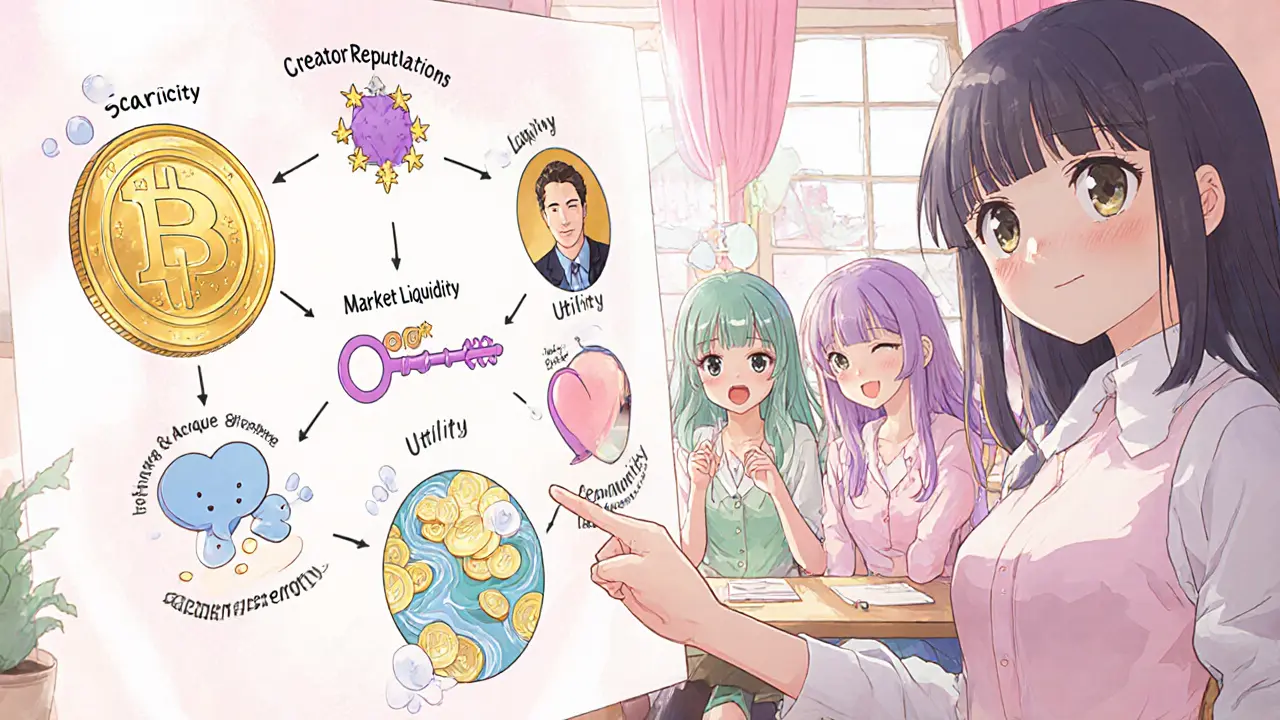

Core Drivers Behind NFT Value

Four pillars consistently explain why an NFT commands a price tag:

- Digital Scarcity: Limited mint numbers create artificial rarity.

- Market Demand: Collector interest, hype cycles, and broader crypto sentiment push prices up or down.

- Creator Reputation: Established artists or influencers bring built‑in trust.

- Utility & Functionality: Tokens that unlock real benefits (virtual land, exclusive events) carry extra premium.

Each pillar interacts with the others - a famous creator can mint a large collection, but if the utility is weak, the floor may still slump.

How Scarcity and Rarity Translate to Numbers

Scarcity isn’t just “only 10 copies exist.” It’s about attribute rarity within a collection. For example, a CryptoPunk with a “Alien” head trait appears in less than 0.1% of the 10,000‑item series, often fetching 10‑plus times the average price.

Collectors use rarity scores from platforms like Rarity.tools to rank items. Higher scores usually equal higher resale values, but only when paired with demand.

Understanding the Floor Price

Floor price is the lowest listed price for any token in a specific NFT collection on secondary markets. It acts as a quick entry point for newcomers and a health bar for the project. When the floor climbs steadily, it signals confidence; a rapid drop often flags risk.

Floor prices are fluid, recalculated every time someone lists a token at a new low. A popular collection might have a floor of 2ETH today and 1.2ETH tomorrow if a whale decides to sell a batch at a discount.

Liquidity, Trading Volume, and Price Stability

Market liquidity refers to how easily an NFT can be bought or sold without drastically moving its price. Research from ETH Zurich shows that higher liquidity and robust trading volume are the strongest predictors of price stability. Collections that see daily trades tend to hold their floors better than those with occasional sales.

Conversely, low‑volume projects can experience wild price swings - a single large sale may push the floor up or down by 30% in minutes.

Creator Reputation and Community Influence

When a well‑known digital artist like Beeple or a celebrity such as Paris Hilton drops an NFT, the base price often starts high because buyers trust the creator’s brand. Community engagement matters too: active Discord servers, frequent AMA sessions, and transparent roadmaps keep collectors hooked.

Interestingly, academic studies find a negative correlation between raw social‑media chatter and long‑term prices. Too much hype can inflate short‑term bids, only for the market to correct later.

Utility: The New Money‑Maker

Beyond eye‑candy, NFTs now serve as tickets, memberships, and even income generators. Virtual real‑estate parcels in Decentraland that earn rent, or access‑based tokens that let owners join exclusive music events, consistently sell above comparable art‑only NFTs.

Utility adds a tangible benefit, making the token appealing to investors who look for cash‑flow or exclusive experiences, not just bragging rights.

Technical Factors That Nudge Prices

On‑chain conditions influence the final asking price:

- Gas fees: High Ethereum transaction costs can deter buyers, prompting sellers to lower prices.

- Blockchain congestion: Network delays affect the timing of sales, especially during market spikes.

- Currency volatility: Since most NFTs are priced in ETH, a sudden dip in ETH/USD can make a token appear cheaper in fiat terms, impacting buyer perception.

- Royalty structures: Smart contracts that enforce creator royalties (usually 5‑10%) can affect the resale price floor, as buyers factor ongoing fees into their bids.

Comparing Value Drivers - Quick Reference

| Driver | Typical Impact | Measurement Metric |

|---|---|---|

| Scarcity / Rarity | High - can double or triple floor | Trait rarity score, supply count |

| Creator Reputation | Medium‑High - premium pricing for known artists | Follower count, past sales price |

| Utility | Medium - adds 20‑50% premium depending on benefit | Access rights, income potential |

| Market Liquidity | Stability factor - smoother price curves | Daily trading volume, sell‑through rate |

| Community Strength | Medium - boosts floor during active phases | Discord members, active wallet count |

Step‑by‑Step: How to Evaluate an NFT’s Price

- Check the floor price on marketplaces like OpenSea or LooksRare.

- Assess rarity by reviewing trait scores.

- Research the creator’s previous drops and overall reputation.

- Look for any utility attached to the token (e.g., virtual land, event access).

- Gauge community activity - Discord members, recent announcements, and developer roadmaps.

- Consider on‑chain costs: current gas price, ETH/USD volatility, and royalty percentage.

- Compare recent sales of similar rarity tiers to estimate a fair market range.

Common Pitfalls to Avoid

- Chasing hype: Buying solely because a token is trending can backfire when the buzz fades.

- Ignoring liquidity: Low‑volume assets are hard to exit without a steep discount.

- Overlooking gas fees: During network congestion, buying at “normal” price may effectively cost far more.

- Neglecting utility: Tokens without functional benefits often plateau quickly.

Future Outlook: Where Will NFT Value Go?

As the ecosystem matures, the focus shifts from pure speculation to real use cases. Gaming NFTs that grant in‑game assets, decentralized identity tokens, and DAOs issuing membership NFTs are set to dominate the next wave. Regulatory clarity and institutional adoption could also stabilize pricing, making NFTs a more reliable asset class for long‑term investors.

Frequently Asked Questions

What makes an NFT different from a regular cryptocurrency?

A regular cryptocurrency like Bitcoin is fungible - every coin is identical and interchangeable. An NFT is non‑fungible, meaning each token has a unique ID and distinct metadata, which can represent art, collectibles, or any one‑of‑a‑kind asset.

How is the floor price calculated?

The floor price is simply the lowest active listing for any token within a collection on a given marketplace. It updates in real‑time as sellers add or remove listings.

Can I earn passive income from NFTs?

Yes. NFTs that represent virtual land, royalty‑sharing music tracks, or staking mechanisms can generate ongoing revenue streams for owners.

Do gas fees affect NFT pricing?

High gas fees increase the total cost of buying or selling an NFT. Sellers often lower the asking price to offset buyer’s transaction expenses, especially during network congestion.

What should I look for before buying an NFT?

Start with the floor price, check rarity scores, verify the creator’s track record, assess any utility, and make sure the community is active. Finally, factor in gas fees and royalty rates.

Iva Djukić

March 18, 2025 AT 14:39When we analyze the valuation mechanisms of NFTs through the lens of epistemological constructs, it becomes evident that the interplay of scarcity and perceived utility operates as a dialectical synthesis of market forces and cultural capital. The scarcity factor, quantified by the limited mint count, is not merely a numeric constraint but a symbolic gesture toward exclusivity, resonating with the human predilection for the rare. Concurrently, the creator's reputation functions as a form of epistemic authority, wherein prior achievements engender trust and, by extension, a price premium that reflects the intersubjective validation of artistic merit. Utility, in its manifold manifestations-ranging from in‑game advantages to access‑based experiences-introduces a phenomenological dimension that transcends aesthetic appreciation, thereby augmenting the token's intrinsic value. Moreover, market liquidity acts as a stabilizing vector, attenuating volatility by ensuring that the asset can be exchanged without disproportionate price displacement. Community strength, often manifested through Discord engagement and collective governance, further compounds value by fostering a network effect that amplifies demand. The synthesis of these pillars can be modeled using a weighted algorithmic framework where each driver contributes a proportional share to the composite valuation score, reminiscent of multi‑factor financial models. Empirical studies, such as those conducted by ETH Zurich, substantiate the predictive power of liquidity and trading volume, underscoring their role as leading indicators of price stability. In practice, collectors should therefore calibrate their acquisition strategies by interrogating each of these dimensions, employing tools like rarity scores and floor price analytics to derive a nuanced assessment. This systematic approach mitigates the risk of speculative exuberance, which historically has precipitated market corrections. Finally, the evolving regulatory landscape and the incipient institutional adoption are poised to impose a structural shift, potentially attenuating the speculative volatility that currently characterizes many NFT markets. By internalizing these multifaceted considerations, participants can navigate the NFT ecosystem with both rigor and strategic foresight.

WILMAR MURIEL

March 22, 2025 AT 23:47Reading through the comprehensive breakdown, I can't help but feel a deep sense of empathy for newcomers who might be overwhelmed by the sheer number of variables at play. It really helps to piece together each component-scarcity, creator reputation, utility, liquidity, and community-in a step‑by‑step manner. By focusing first on the floor price and rarity, you build a solid foundation, then layering on creator pedigree and utility creates a richer narrative around the asset. This approach not only demystifies the process but also empowers collectors to make more confident decisions, which is essential for fostering a healthier market ecosystem. Keep encouraging this kind of structured thinking; it builds confidence and knowledge simultaneously.

carol williams

March 27, 2025 AT 08:56From a formal perspective, the methodological framework outlined in the article aligns closely with established asset valuation theories, yet it adapts them to the idiosyncrasies of blockchain‑based collectibles. The integration of quantitative metrics such as rarity scores and liquidity ratios, alongside qualitative considerations like creator credibility and community vibrancy, creates a dual‑layered analysis that is both robust and nuanced. This synthesis facilitates a more accurate estimation of intrinsic value, thereby reducing reliance on speculative sentiment alone. Moreover, the emphasis on on‑chain variables-gas fees, network congestion, and royalty structures-underscores the importance of transactional frictions in price formation, a factor often overlooked in traditional financial models. Consequently, the presented evaluative model serves as a valuable tool for both practitioners and scholars seeking to comprehend the multi‑dimensional nature of NFT markets.

Maggie Ruland

March 31, 2025 AT 19:05Wow, that's a lot of jargon.

jit salcedo

April 5, 2025 AT 04:13Honestly, the whole NFT hype train is just a massive distraction engineered by shadowy elites to siphon off decentralized wealth into their hidden wallets. While everyone is busy debating utility and rarity, the real agenda is to inflate transaction fees, create a perpetual gas‑price nightmare, and then leverage that chaos to push centralised exchange monopolies. If you look closely at the metadata patterns, there's a subtle watermark that only the cabal can decode, ensuring they maintain control over the perceived scarcity. So before you obsess over floor prices, remember that the true value is being eroded by a covert cartel.

Joyce Welu Johnson

April 9, 2025 AT 13:22Great summary! A helpful tip for anyone diving in: always check the royalty percentage on the smart contract-high royalties can bite into resale profits, especially if the NFT’s utility doesn’t justify a premium price. Also, consider the community’s engagement; a lively Discord often signals upcoming drops or collaborations that can boost value. Remember, utility isn’t just a buzzword-tokens that grant real‑world benefits, like exclusive event tickets, tend to hold their value longer than pure art pieces.

Ally Woods

April 13, 2025 AT 22:30meh, looks like another overhyped thing, not much to add.

Kristen Rws

April 18, 2025 AT 07:39Wow! This is super helpful!!! I cant wait to try the calculator and see if my collection is actually worth something. :)

Fionnbharr Davies

April 22, 2025 AT 16:47Thanks for the comprehensive guide. I appreciate the balanced approach that blends quantitative metrics with community insights. It’s especially useful that you highlighted how liquidity and trading volume act as stabilizers in the market. This will definitely inform my future acquisition strategy.

Narender Kumar

April 27, 2025 AT 01:56Esteemed colleagues, one must acknowledge the gravitas of the discourse surrounding non‑fungible token valuation. The confluence of scarcity, provenance, and functional utility presents a tableau of considerations that merit the utmost scholarly attention. In my estimation, the emphasis on utility heralds a paradigm shift, elevating NFTs from mere aesthetic objects to instruments of tangible benefit. Consequently, the diligence applied in assessing these facets shall undoubtedly yield a more robust comprehension of market dynamics.

Anurag Sinha

May 1, 2025 AT 11:05While the eloquent treatise on NFT economics may appear polished, one cannot ignore the underlying power structures that manipulate scarcity for profit. The very notion of "utility" is frequently co‑opted by corporate interests seeking to embed themselves within decentralized ecosystems. This subtle orchestration ensures that the average participant remains ensnared in a cycle of dependency, perpetuating the dominance of an elite few.

Raj Dixit

May 5, 2025 AT 20:13The moral imperative is clear: avoid projects that incentivize speculation over genuine value creation.

Lisa Strauss

May 10, 2025 AT 05:22I'm feeling really hopeful about this! Even if the market dips a bit, the long‑term potential of NFTs with real utility is exciting. Let's keep supporting creators and building strong communities!

Darrin Budzak

May 14, 2025 AT 14:30Nice rundown. I think the key takeaway is to look for NFTs that have both a solid floor and an active community – that combo usually means the price will hold up better over time.

Andrew McDonald

May 18, 2025 AT 23:39Interesting points, but let’s be realistic: most of these so‑called "utility" tokens are just marketing gimmicks. 😏

Enya Van der most

May 23, 2025 AT 08:47Hey team! Let’s remember that NFTs can be a force for good when they empower creators and give fans exclusive experiences. Keep pushing for projects that add real value, not just hype.

Eugene Myazin

May 27, 2025 AT 17:56Love this guide! It’s a solid starting point for anyone looking to dip their toe into the NFT world without getting lost in the noise.

Latoya Jackman

June 1, 2025 AT 03:05The explanation is clear and well‑structured; it accurately reflects the current state of NFT valuation, highlighting both quantitative and qualitative factors.

karyn brown

June 5, 2025 AT 12:13👍 Great stuff! The breakdown of rarity and utility really helped me understand why some NFTs skyrocket while others flop. 🔥

Megan King

June 9, 2025 AT 21:22Thanks for the thorough overview! I’ll definitely keep an eye on community activity and utility when I evaluate new drops.

Rachel Kasdin

June 14, 2025 AT 06:30Patriots of the crypto world must ensure we back only home‑grown projects that respect our digital sovereignty. Support native creators!

Nilesh Parghi

June 18, 2025 AT 15:39Overall, this guide is a friendly compass for navigating the NFT landscape-clear, practical, and easy to follow.