Smart Contracts – How They Work, Why They Matter

When working with Smart Contracts, self‑executing code that runs on a blockchain when predefined conditions are met. Also known as automated contracts, it removes the need for a middleman and guarantees that the agreement is enforced exactly as written. Smart contracts sit on top of a blockchain, a distributed ledger that provides the trust and immutability needed for the code to run safely. This relationship means that a smart contract requires a blockchain to execute, and the blockchain enables the contract to be transparent and tamper‑proof. Because the code lives on a public network, anyone can verify the terms, which reduces disputes and speeds up transactions. The combination of code and ledger is the foundation for everything from token sales to automated payments.

How Smart Contracts Power Decentralized Apps and Token Economics

One of the biggest ways smart contracts show their value is through decentralized applications, or dApps. A dApp is simply an app whose backend logic lives inside smart contracts instead of a central server. This setup lets developers create services that stay online as long as the blockchain does, without a single point of failure. In practice, a dApp might be a lending platform, a game, or a voting system—each of them runs its rules automatically thanks to the underlying contracts. Tokenomics—the economic design of a cryptocurrency—relies heavily on smart contracts to enforce supply caps, distribution schedules, and reward mechanisms. When a token’s inflation rate is set in code, the contract makes sure no one can change it without consensus, which builds confidence for investors. Governance tokens are a clear example of this link. Holders of a governance token can submit proposals and vote, and the smart contract tallies the votes and executes approved changes. This means that decision‑making in a DAO (decentralized autonomous organization) is fully automated, transparent, and resistant to manipulation. The contract’s logic also allows for advanced voting methods like quadratic voting, which can be built directly into the code. As a result, smart contracts not only handle financial transactions but also shape how communities govern themselves and allocate resources.

Looking ahead, sidechains and interoperability solutions are expanding what smart contracts can do. A sidechain is a separate blockchain that connects to a main chain, letting developers run contracts with lower fees or faster finality while still trusting the main network’s security. This setup creates a security model where the main chain protects the sidechain, and the sidechain offers specialized features for contracts. Interoperability protocols let a contract on one chain call a contract on another, opening doors for cross‑chain DeFi products and multi‑asset swaps. These advances mean that the smart contract ecosystem is becoming more versatile, with new possibilities for developers, traders, and even regulators. Below you’ll find a curated list of articles that dive deep into specific platforms, token models, and regulatory environments—all tied together by the core idea of smart contracts. Whether you’re hunting for a review of a new DEX, trying to understand tokenomics, or exploring how governance tokens work, the collection gives you practical insights you can act on right away.

What is Web3 and How It Works

Feb, 15 2026

Web3 is a decentralized internet built on blockchain, where users own their data and digital assets instead of corporations. It uses crypto wallets, smart contracts, and distributed networks to remove middlemen - but it's still early, clunky, and risky.

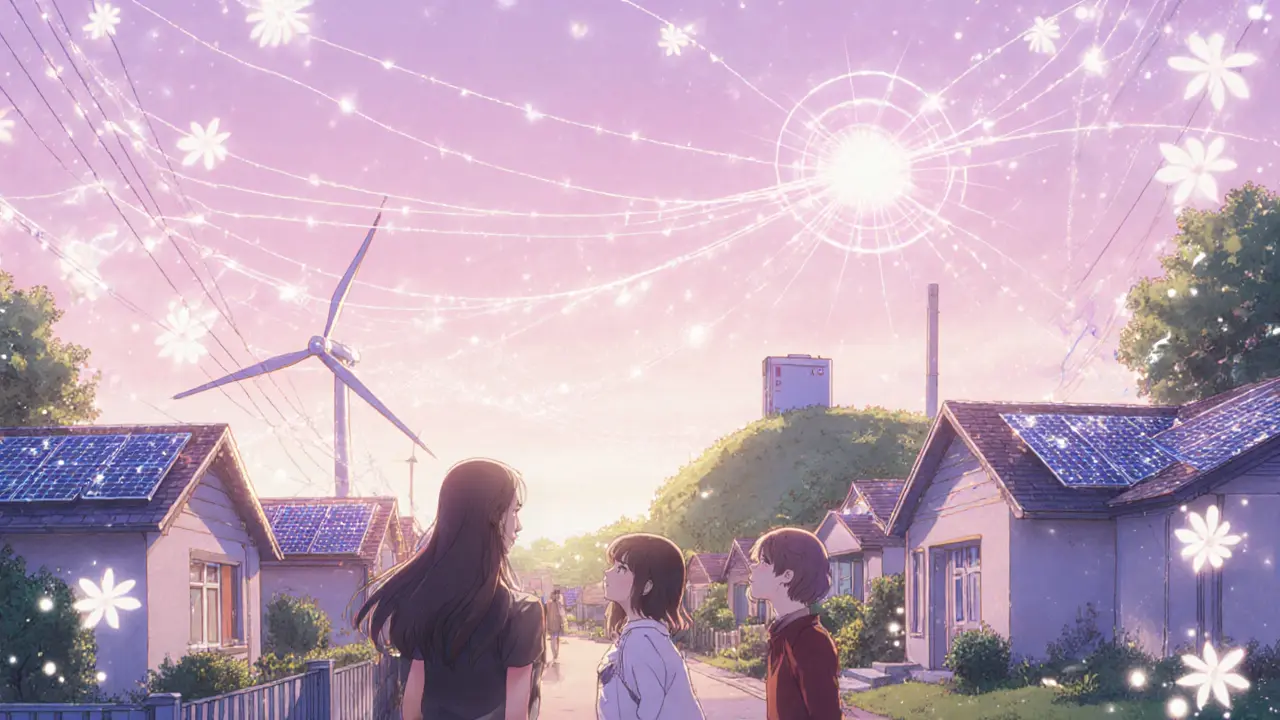

Read Article→How Blockchain Technology is Transforming Microgrids

Sep, 9 2025

Explore how blockchain technology empowers microgrids with peer-to-peer trading, smart contracts, and real-time transparency, reshaping the future of local energy systems.

Read Article→