What Is TEN (TENFI) Crypto Coin? Complete Guide 2025

Oct, 29 2024

Oct, 29 2024

TEN (TENFI) Token Calculator

Current TEN Information

Total Supply: 1 billion TEN

Circulating Supply: 420 million TEN

Transaction Tax: 10% per transfer

Staking Reward: 5% of transaction tax

Burn Rate: 2% of transaction tax

Inflation Rate: 0% after 2027 (deflationary)

Calculator Inputs

Estimated Returns

With 0 TEN tokens and 0 monthly transactions:

- Monthly staking reward: 0 TEN

- Annual staking reward: 0 TEN

- Monthly token burn: 0 TEN

- Projected annual burn rate: 0 TEN

Note: This calculation assumes a 10% transaction tax on all transfers and provides estimates only.

Ever stumbled on a crypto name you’ve never heard before and wondered, “Is this legit? What does it actually do?” That’s the exact feeling many investors have when they first see TENFI crypto coin. Below you’ll get a straight‑forward rundown of what TEN (also called TENFI) is, how it fits into the broader DeFi landscape, and what you should watch out for before putting any money in.

TL;DR

- TEN (TENFI) is a DeFi‑focused token built on an EVM‑compatible blockchain.

- Its core goal is to provide low‑fee, high‑throughput liquidity for decentralized finance apps.

- Tokenomics include a 10% transaction tax split between staking rewards, development fund, and burning.

- You can buy TEN on Binance, KuCoin, and a few DEXes using a compatible wallet.

- Risks: low market depth, regulatory gray area, and unproven tech roadmap.

What Exactly Is TEN (TENFI)?

When we say “TEN” we’re talking about a native utility token that powers the TENFI ecosystem. TENFI is a blockchain‑based token designed to enable fast, cheap, and composable transactions for decentralized finance (DeFi) protocols. In plain English, TEN acts like the fuel that lets developers create lending, swapping, and yield‑farming apps without the bottlenecks you see on older chains like Ethereum.

Where Does TEN Fit in the DeFi Landscape?

DeFi has exploded since 2020, but many platforms still struggle with high gas fees and network congestion. TEN positions itself as a “layer‑2‑lite” solution: it runs on a custom, EVM‑compatible chain that claims sub‑second block times and transaction costs under $0.001. The idea is to give users a smoother experience for everyday actions-swapping tokens, providing liquidity, or staking for rewards-without waiting minutes for confirmation.

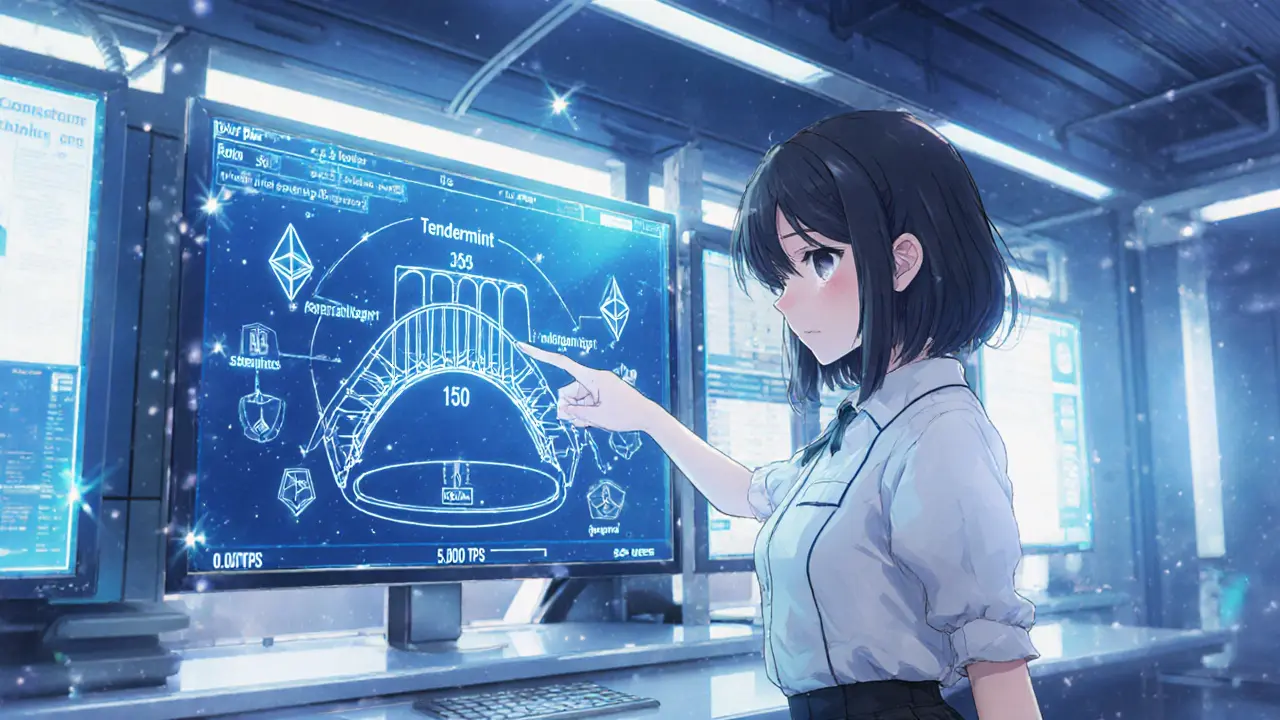

Technology Stack: Blockchain, Smart Contracts, and Infrastructure

The TENFI blockchain is built using the Tendermint consensus algorithm, which offers instant finality and a Byzantine Fault Tolerant (BFT) security model. Being EVM‑compatible means developers can reuse Solidity code, making migration from Ethereum trivial.

Key technical attributes:

- Block time: 0.8 seconds.

- Throughput: up to 5,000 transactions per second (TPS).

- Consensus: Tendermint BFT with a rotating validator set of 150 nodes.

- Interoperability: Native bridges to Ethereum, Binance Smart Chain, and Polygon.

Smart contracts on TEN are audited by third‑party firms like CertiK and PeckShield, and the audit reports are publicly posted on the project’s GitHub.

Tokenomics: How TEN Is Distributed and Used

Understanding tokenomics is crucial because it tells you where incentives lie and how inflation is controlled.

| Metric | Value |

|---|---|

| Total Supply | 1billion TEN |

| Circulating Supply (Oct2025) | 420million TEN |

| Initial Distribution | 40% public sale, 20% team (vested 3years), 15% validators, 15% ecosystem, 10% reserve |

| Transaction Tax | 10% per transfer - 5% to stakers, 3% to development fund, 2% burned |

| Inflation Rate | 0% after 2027 (deflationary due to burn) |

The 10% tax makes the token somewhat deflationary, as a portion is burned each time TEN moves. Stakers earn a share of the tax, encouraging long‑term holding.

Primary Use Cases

What can you actually do with TEN?

- Liquidity Provision: Deposit TEN into automated market makers (AMMs) on TEN’s native DEX to earn a slice of swap fees.

- Staking & Yield Farming: Lock TEN in validator nodes or farm pools to collect a portion of the transaction tax.

- Governance: TEN holders vote on protocol upgrades, fee structures, and treasury allocations.

- Cross‑Chain Payments: Use TEN’s bridges to pay on Ethereum or BSC without paying high gas fees.

How to Buy and Store TEN

If you’re ready to test the waters, here’s a simple checklist.

- Create a compatible wallet: MetaMask, Trust Wallet, or the official TEN Wallet (a mobile crypto wallet that supports the TEN network).

- Buy on a centralized exchange (CEX): TEN is listed on Binance, KuCoin, and Gate.io. You’ll need to verify your account, deposit fiat or a major crypto (BTC/USDT), and place a market or limit order for TEN.

- Transfer to your wallet: Withdraw the TEN from the exchange to your personal address. Double‑check the network (TEN) to avoid losing funds.

- Optional - Use a DEX: If you prefer decentralized routes, connect your wallet to TenSwap (the native DEX) and swap BNB or ETH for TEN via the built‑in bridge.

Always keep a backup of your seed phrase; losing it means losing access to your TEN forever.

Risks and Red Flags to Watch

No crypto is risk‑free, and TEN comes with its own set of challenges.

- Market Depth: Daily volume hovers around $5million, making large purchases prone to slippage.

- Regulatory Uncertainty: Because TEN is a utility token with staking rewards, some jurisdictions may treat it as a security.

- Development Transparency: The roadmap is semi‑public; major milestones rely on community voting, which can delay progress.

- Smart‑Contract Bugs: Despite audits, DeFi exploits happen. Keep only what you can afford to lose in any TEN‑related contract.

If any of these points give you pause, consider allocating a small test amount first and watching how the ecosystem evolves over the next few months.

How TEN Stacks Up Against Similar DeFi Tokens

| Attribute | TEN (TENFI) | UNI | AAVE |

|---|---|---|---|

| Primary Chain | TEN Network (EVM‑compatible) | Ethereum | Ethereum |

| Transaction Cost (avg) | ~$0.001 | ~$2.30 | ~$2.10 |

| Block Time | 0.8s | 13s | 13s |

| TPS | 5,000 | 30 | 30 |

| Governance Model | Token‑weighted voting | Token‑weighted voting | Token‑weighted voting |

| Staking Reward Source | 10% transaction tax | Liquidity mining incentives | Safety module rewards |

| Market Cap (Oct2025) | $78million | $7.6billion | $2.9billion |

In short, TEN shines on speed and cost, but it lags behind market‑size giants like UNI and AAVE. If ultra‑low fees matter to you, TEN is worth a look; if you value deep liquidity and established DeFi products, you may stick with the larger tokens.

Future Outlook: Roadmap Highlights

The TEN team has laid out a three‑phase plan through 2026.

- Phase1 (Q32024‑Q22025): Launch mainnet, integrate bridges to Ethereum and BSC, and seed the validator set.

- Phase2 (Q32025‑Q22026): Deploy TenSwap V2 with advanced AMM curves, introduce cross‑chain yield farms, and roll out a governance dashboard.

- Phase3 (2027+): Aim for full decentralization-remove the core development fund, shift to DAO‑controlled treasury, and explore Layer‑0 interoperability.

Keep an eye on the official Telegram and Discord channels; the team often releases milestone updates there first.

Bottom Line: Should You Consider TEN?

If you’re a DeFi enthusiast frustrated by high fees, TEN offers a cheap, fast alternative that’s still in its growth phase. Its tokenomics create built‑in incentives for holders, but the market is shallow and regulatory risk remains. Treat it like any other speculative token: allocate a modest portion of your portfolio, stay updated on governance votes, and be ready for volatility.

Frequently Asked Questions

What is the total supply of TEN?

TEN has a fixed total supply of 1billion tokens, with about 420million currently in circulation.

How does staking work on TEN?

When you lock TEN in a validator node or a staking pool, you receive a share of the 10% transaction tax (5% goes to stakers). Rewards are distributed daily and can be claimed at any time.

Which exchanges list TEN?

As of October2025, TEN is available on Binance, KuCoin, Gate.io, and a few decentralized exchanges like TenSwap.

Is TEN considered a security?

Regulatory opinions differ by jurisdiction. Because TEN offers staking rewards, some regulators may treat it as a security, so always check local laws before investing.

How can I participate in TEN governance?

Hold TEN in a compatible wallet, then connect to the governance portal (govern.tenfi.org). Proposals are voted on using a token‑weighted system; each TEN equals one vote.

Enya Van der most

October 29, 2024 AT 13:43Wow, TEN looks like a wild ride! The 10% tax on every transfer totally flips the game on its head, and that 5% staking reward is sooo juicy. Imagine earning passive income just by holding, that's the kind of magic we love. With 2% of each tax burning, the supply will shrink over time – deflationary vibes! If you’re into high‑risk, high‑reward tokens, TEN is screaming your name. Strap in, do your research, and don’t forget to set those alerts!

karyn brown

October 30, 2024 AT 02:13Sounds risky 😂

Megan King

October 30, 2024 AT 14:43Hey folks, just a heads‑up: TEN’s tokenomics are pretty unique, so make sure you understand the 10% transaction tax before diving in. The staking reward of 5% comes from that tax, so the more activity, the more you could earn. Also, watch the burn rate – 2% of each tax is taken out of circulation, helping the price over time. Give it a test run with a tiny amount if you’re unsure. Stay safe and happy investing!

Rachel Kasdin

October 31, 2024 AT 03:13Look, I'm not here to sugar‑coat anything – TEN is just another gimmick trying to ride the hype wave. The 10% tax is basically a hidden fee that will eat your profits if you move often. And that “deflationary after 2027” claim? Who knows if they’ll actually enforce it. If you value real utility over flashy numbers, there are better options out there. Think twice before you get caught in the hype train.

Adeoye Emmanuel

October 31, 2024 AT 15:43When you examine TEN through a philosophical lens, you realize it mirrors the duality of creation and destruction. The tax acts as a societal contribution, while the burn mechanism embodies entropy. Yet, the promise of future deflation suggests an aspirational order emerging from chaos. One could argue the token reflects humanity’s perpetual quest for balance. In the end, it’s a poetic experiment in economic theory.

Rahul Dixit

November 1, 2024 AT 04:13Honestly, the whole “transparent tokenomics” story is a cover. Who’s really behind TEN? I bet there’s a shadow group manipulating the burn to pump the price at will. The 10% tax is just a funnel to funnel money into secret wallets. Keep your eyes peeled – the crypto world is full of staged drama. Stay skeptical and protect your assets.

CJ Williams

November 1, 2024 AT 16:43Okay, let’s break it down – TEN’s 10% tax is split into 5% for stakers, 2% burned, and the rest? Probably goes to the dev fund!! 🚀🚀 That means if you hold, you earn while the supply shrinks – a win‑win! Just remember to set your wallet to auto‑stake so you don’t miss out!!! If you’re new, start small and watch the rewards roll in. Happy staking!! 😎

mukund gakhreja

November 2, 2024 AT 05:13Sure, let’s trust a token that taxes every move – brilliant strategy. Real talk, it’s just another way to milk people.

Michael Ross

November 2, 2024 AT 17:43I appreciate the thorough breakdown. It’s important to weigh the pros and cons. Always do your own research before committing.

Deepak Chauhan

November 3, 2024 AT 06:13From a formal standpoint, TEN’s architecture adheres to a recognizable model of tokenomics, yet the practical implications may differ. The tax allocation provides a direct incentive for holders, aligning interests across participants. Nonetheless, the sustainability of such a model relies heavily on community engagement. One must therefore assess both the theoretical and empirical facets before participation.

Aman Wasade

November 3, 2024 AT 18:43Well, if you enjoy watching your coins slowly evaporate into a tax, TEN is your ticket. I guess some people like the drama of a burning candle.

Ron Hunsberger

November 4, 2024 AT 07:13Here’s a quick summary for newcomers: TEN imposes a 10% transaction tax, which is partially redistributed as a 5% staking reward. Additionally, 2% of the tax is burned, reducing total supply over time. The circulating supply is currently 420 million out of a 1 billion total. If you hold TEN, you’ll earn passive income from the staking pool while the token becomes increasingly scarce. Always make sure to use a wallet that supports auto‑staking to maximize rewards.

Lana Idalia

November 4, 2024 AT 19:43Let’s be real – the math looks sweet on paper, but the real world is messy. You’ll see many folks thinking they’re getting free money, but the tax can bite you hard if you move often. And hey, the “deflation after 2027” promise? Might just be a marketing buzzword. Do your own deep dive before you throw anything in.

Henry Mitchell IV

November 5, 2024 AT 08:13Just a heads‑up, always double‑check the contract address before you send anything. A tiny mistake can cost you big time. Stay safe out there! 😊

Kamva Ndamase

November 5, 2024 AT 20:43Listen up, TEN is the kind of token that screams “loud and proud” – the tax, the burn, the staking, all in one package. It’s aggressive, but that’s the point – it wants to dominate the market. The colorful tokenomics are designed to attract those who love high‑octane crypto. If you’re ready to ride the wave, TEN could be your ticket. Just remember, high volatility means high risk.

bhavin thakkar

November 6, 2024 AT 09:13Technically, TEN follows a standard ERC‑20 framework, but the tokenomics are anything but standard. The 5% staking reward directly incentivizes long‑term holding, which is a clever move. However, the constant 10% tax can deter frequent traders, creating a barrier to liquidity. In theory, the burn mechanism should create scarcity, potentially driving price up. The real question is whether the community can sustain enough activity to keep the ecosystem alive.

Thiago Rafael

November 6, 2024 AT 21:43From an analytical perspective, TEN’s model is a double‑edged sword. The redistribution of 5% of each transaction promotes staking participation, while the 2% burn incentivizes scarcity. Yet, the 10% overall tax may discourage high‑frequency trading, limiting market depth. Investors should evaluate whether the potential rewards offset the friction imposed by the tax. Ultimately, due diligence remains paramount.

Marie Salcedo

November 7, 2024 AT 10:13Hey everyone! TEN offers a neat way to earn while you HODL, which is great for newcomers. The tax might seem high, but the burn and staking rewards balance it out. Give it a try with a small amount and see how it feels!

Krystine Kruchten

November 7, 2024 AT 22:43Nice intro, but remember the 10% tax hits everytime you move – that's a real cost. If you plan to trade often, those fees add up fast. The staking is cool, yet only works if enough people keep the token staked. Keep these points in mind before diving deep.

Mangal Chauhan

November 8, 2024 AT 11:13Just to add, TEN’s ecosystem is designed to reward patience. The auto‑stake feature means you don’t have to manually claim rewards – just set it and forget it! 😊 Also, the burn mechanism gradually reduces supply, which could support price appreciation over time. Make sure your wallet supports the token’s contract to avoid hiccups. Happy investing, and may your returns be plentiful!

Iva Djukić

November 8, 2024 AT 23:43When dissecting the tokenomic architecture of TEN, one must first acknowledge the intricate interplay between its tax allocation, staking incentives, and supply modulation mechanisms. The 10% transaction tax functions as a multifaceted conduit, diverting a quintuplet of percent toward passive yield generation for stakers, thereby aligning stakeholder interests with network longevity. Concurrently, a bifurcated 2% sub‑tax earmarked for token burn systematically attenuates the circulating supply, engendering a deflationary pressure that, in theory, catalyzes price appreciation as scarcity intensifies. This dual‑pronged approach is further nuanced by the residual 3% of the tax, which is ostensibly allocated to a development reserve, ensuring continuous protocol upgrades and ecosystem expansion. Such a design paradigm encapsulates both macro‑economic considerations-namely, supply‑demand dynamics-and micro‑economic incentives that reward liquidity provision. Moreover, the token’s circulating supply of 420 million against a capped ceiling of one billion introduces a quantifiable metric for participants to gauge market penetration and potential upside. The staking reward, calibrated at 5% of the total tax, is distributed proportionally among token holders who engage in the auto‑staking contract, fostering a passive income stream that mitigates the friction introduced by the tax itself. From a risk assessment perspective, the inherent volatility engendered by the tax structure necessitates diligent portfolio allocation, especially for traders with high turnover strategies, as the tax erodes net returns on frequent transactions. Conversely, long‑term holders stand to benefit disproportionately from the cumulative effects of the burn schedule, particularly post‑2027 when the protocol ostensibly transitions to a zero‑inflation regime, thereby solidifying its deflationary ethos. It is also prudent to examine the governance framework, which currently lacks explicit on‑chain voting mechanisms, potentially centralizing decision‑making authority within a limited consortium of core developers. This governance opacity could introduce systemic risk, especially in scenarios requiring rapid response to market adversities or security vulnerabilities. In summation, TEN presents a sophisticated synthesis of incentivization and scarcity, yet prospective investors must weigh the tax‑induced frictions against the projected yield and deflationary benefits, all while maintaining vigilance regarding governance centralization and protocol adaptability.

Darius Needham

November 9, 2024 AT 12:13From a cultural standpoint, the global crypto community values transparency, so projects like TEN need to openly share roadmap updates. The tax model is unique, but it should be balanced with user-friendly experiences. Engaging with local meetups can provide deeper insights into how such tokens perform in different markets. Stay curious and keep learning!